With pressure for building decarbonization mounting from tenants, investors, lenders and regulators, building operators and facilities managers are relying on digital tools to manage cost concerns related to energy efficiency upgrades and retrofits, experts say.

Building tenants are increasingly seeking spaces that perform well on environmental performance indicators like energy intensity and electrification. Despite tenants’ willingness to pay a premium for sustainable spaces, the demand for such buildings is outpacing supply. JLL’s 2024 global occupier outlook, released in January, forecasts that only 25% of total demand for low-carbon spaces will be satisfied by 2030. Decarbonization commitments will also play a larger role in lease renewals, with 77% of the top 100 occupiers across eight U.S. markets that JLL surveyed saying that their renewals will be tied to carbon commitments.

Second, investors are urging companies to be transparent about their sustainability performance, according to a Cortex Sustainability Intelligence report. There is a growing investor awareness that sustainable properties command greater value. A global real estate survey conducted by JD Supra reveals that around 71% of investors it surveyed expect properties with strong energy performance standards to attract higher resale values, greater occupier demand and higher-quality tenants than those with weaker standards. Three-fourths of those same investors surveyed believe that the “green premium” mostly applies to buildings that meet official sustainability certifications such as LEED and BREEAM. Lenders are increasingly scouting for such green certifications and other sustainability-driven budget allocations too, David Borchardt, senior mechanical engineer at MD Energy Advisors, said at a panel on energy use benchmarking in October.

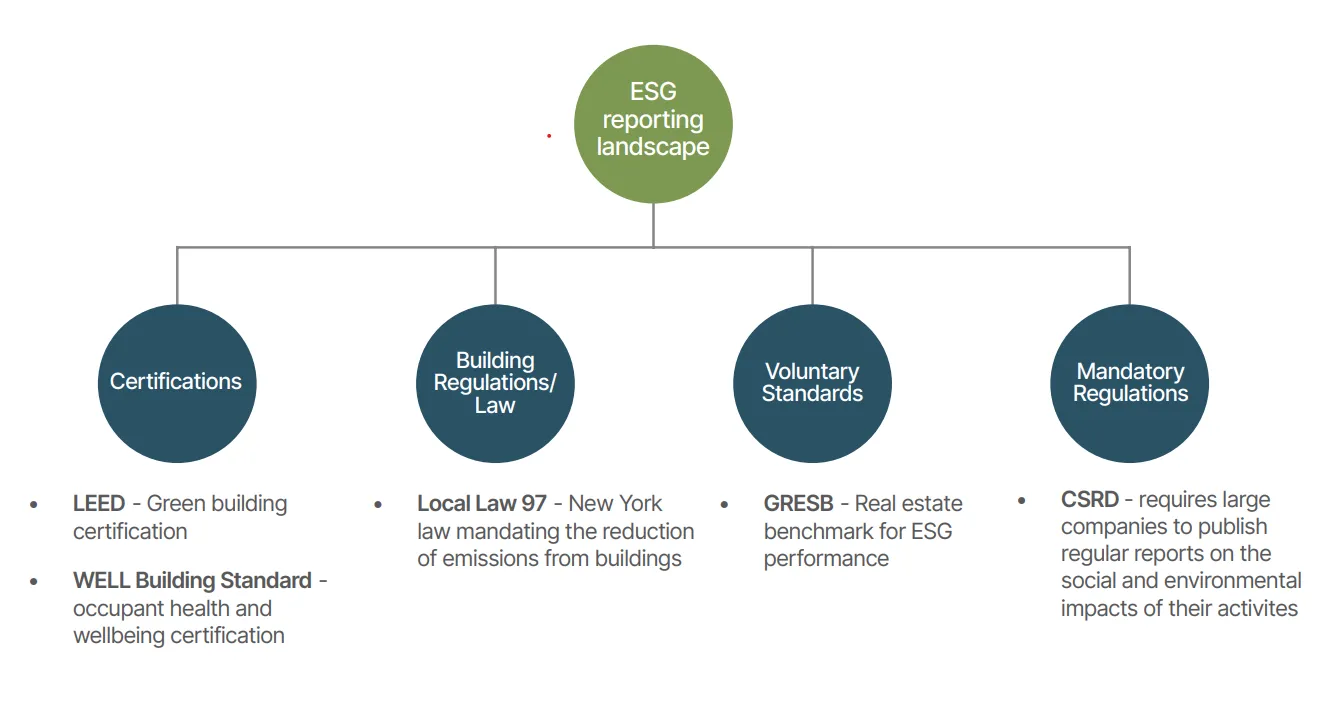

Federal, state and local governments are increasingly focused on energy efficiency standards and carbon emissions reporting and reduction in both new and existing commercial real estate. Laws and policies to that effect range from New York City’s Local Law 97 and Detroit’s adoption of an energy and water benchmarking policy for existing buildings to California’s legislative measures aimed at standardizing corporate climate disclosures, which some market commentators say echo certain requirements of the U.S. Securities and Exchange Commission’s climate rules, expected to be released in April.

“The urgency for action in the building sector is undeniable,” said Lisa Rockefeller, chief revenue officer at Cortex Sustainability Intelligence. “There is a need in the industry to connect corporate ESG goals with building-level engineering goals” to effect the building-level change required to meet ESG targets, she said. The SEC’s expected climate disclosure rule will be “critically important” in facilitating accurate, auditable and transparent sustainability reporting, she noted, as will more robust data collection. Rockefeller expects commercial real estate professionals to undertake proactive steps toward decarbonization this year, with a focus on enterprise-level digital tools that provide real-time actionable data and allow operators to reduce energy costs and carbon emissions while maintaining tenant comfort.

“Facilities managers are trying to figure out how to reduce their scope 1 emissions, particularly those related to direct fossil fuel consumption within buildings,” said Paul Torcellini, principal engineer for the U.S. National Renewable Energy Laboratory’s commercial buildings research group. “And the good news is that the industry is responding,” he said.

Key starting points for decarbonization

“This year … data and AI-driven maintenance, automated systems optimization, energy reporting and carbon tracking and reporting will become accepted as essential to how buildings are operated and managed,” Ken Carroll, managing director of corporate real estate consulting and technology at EY, said in an interview.

Andre Marino, senior vice president of digital buildings at Schneider Electric, noted that “For many, the biggest question is where to start. Often constrained by existing budgets, implementing solutions that can help reach sustainability and net-zero benchmarks can seem daunting.”

As a starting point, building operators and facilities managers are turning to comprehensive energy efficiency assessments, which provide a holistic view of a building’s energy profile, according to Ronak Shah, senior energy analyst at InSite. While the focus is on “recalibrating the energy equation within the built environment,” IoT devices and building management systems can facilitate the real-time monitoring and data analytics needed to implement predictive maintenance, forecast energy use and engage in demand response strategies, Shah said. Other focal points for initiating the process of building decarbonization include enhancing building envelope components like insulation, windows and roofing to minimize heating, cooling and electrification demands, he added.

Ensuring an effective building envelope will help building owners implement electrification projects at a later stage, said Jon Moeller, chief operating officer of BlocPower, a climate technology firm that manages retrofit projects in commercial properties, community centers and multifamily complexes.

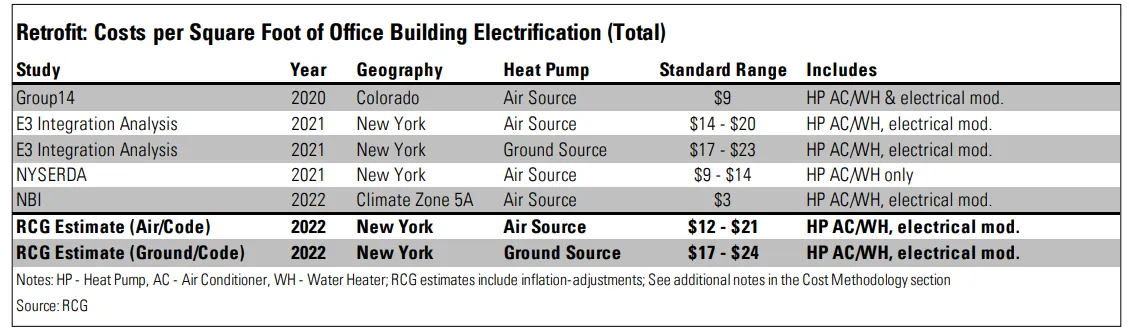

Facilities managers looking to invest in energy efficient technologies are faced with high costs, despite access to federal incentives. For example, the cost of retrofitting a typical gas-powered office building in New York state with a ground-source heat pump can be as much as $24 per square foot, while that of deploying an air-source heat pump can reach $21 per square foot, according to June 2022 Rosen Consulting Group estimates. Using those estimates, the cost for installing an air-source heat pump in a 500,000-square-foot building in New York could be as much as $10.5 million. The report notes that while heat pump retrofits in office buildings have the potential to create “significant energy bill savings” on an ongoing basis, these estimates are predicated upon additional building shell improvements that would partially incur costs.

“We’re at an unprecedented time of change for facilities management, where the dual objectives of cost efficiency and sustainable action can seem at odds,” said Travis Sheehan, North America lead for city & hubs at Shell Energy. He pointed to energy efficiency measures, equipment upgrades and advanced energy management systems that are designed to shift energy usage patterns for cost savings as other decarbonization pathways.

“Weatherization is often a cost-effective and good first step with quick payback,” BlocPower’s Moeller said, noting that he has seen IoT-connected, energy-efficient technology like air source heat pumps have “a big impact” on cost savings and comfort.

NREL’s action plan template emphasizes that improving buildings’ energy efficiency is “usually the most cost-effective and least disruptive strategy” to rein in energy use and implement other carbon emissions reduction strategies. Reducing a building’s energy consumption by 50%, for example, doubles the impact of the renewable energy it purchases or generates on a percentage basis, it says.

Budgets for reducing emissions

Investments in energy efficiency can generate savings that building owners and managers could direct toward building decarbonization. However, inflation, high interest rates and tight market conditions for the skilled labor that decarbonization efforts require are concerns.

Inflation in prices and wages, along with the shortage of skilled technicians, lie beyond the control of facilities managers, according to EY’s Carroll. “More efficient equipment can be very effective in progressing toward decarbonization. However, expecting and assuming that installing newer hardware, like heat pumps, will be perfect and [that] their sequence of operations will be well designed for best-in-class performance, would be unwise,” he said. A well-thought-out strategy that involves leveraging digital technologies and solutions “needs to be designed and implemented alongside — not in lieu of — these … equipment upgrades” to optimize the performance of energy-efficient equipment in buildings, he added.

Strategically selecting energy-efficient technologies with rapid payback periods can mitigate the risk of inflation eroding the purchasing power of future savings and impacting the long-term feasibility of energy-efficiency investments, InSite’s Shah noted. “For example, LED lighting upgrades not only reduce energy consumption, but also provide quick returns on investment, offering a buffer against the impact of inflation,” he said.

Implementing robust monitoring systems based on real-time data allows facilities managers to make informed decisions and maximize the efficiency of the long-term benefits of energy efficiency investments, Shah said. To strategically choose projects, he recommends conducting a thorough life cycle cost analysis, which can guide the adoption of a phased approach by prioritizing projects based on potential energy savings and scalability, ensuring that these investments align with long-term financial goals.

Building owners and operators can also tap into financial support mechanisms provided by the Inflation Reduction Act, such as a 30% tax credit for certain geothermal heat pump installations through 2032 and Section 179D, which offsets commercial owners’ energy efficiency improvements with tax deductions. These deductions range from 50 cents to $1 per square foot, with a potential to increase to as much as $5 per square foot if they meet certain wage and apprenticeship requirements. “It’s enough money that you can shave off a third of the $24-per-square-foot, in-ground-source heat pump retrofitting costs,” NREL’s Torcellini said, referring to the Rosen Consulting Group’s estimates.

To effectively utilize those tax deductions, as well as state and local equivalents, owners and operators are engaging with experts on these regulations, Carroll said. “The 179D shows there are measures that must be calculated to qualify, and these must be calculated by approved software, which underscores the need for a sound digital strategy,” he said.

To ensure balanced budgets and an actionable approach to reducing emissions, organizations should create a measurable road map to decarbonization, Marino said. This involves establishing a baseline, deploying digital solutions to determine where budgets can be best spent and electrifying building loads by drawing on renewable energy sources and engaging the value chain and its emissions. “Commitments are being made,” Marino said, “but action needs to happen at least [three times] faster.”

Correction: In a previous version of this story, Shah's first name and Travis Sheehan's title were incorrect. The correct name is Ronak Shah, and Sheehan's title is North America lead for city & hubs at Shell Energy.