Dive Brief:

- AI requirements, along with the continued adoption of cloud services, are boosting demand for data centers to record levels this year, according to a new JLL report.

- The H1 2023 North America Data Center Report notes that financial firms, healthcare organizations, hyperscalers and other major enterprises swiftly reserved data center space mainly for July through year-end, and expects a continued race for space in 2024 amid supply shortfalls.

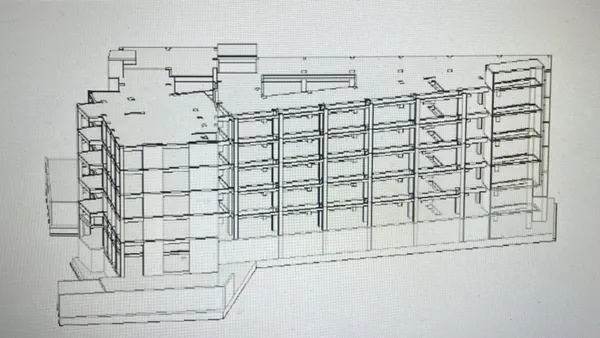

- Notable trends that JLL’s senior research manager, Kari Beets, identified in a press release on the report include an increase in data-space leasing and a need for higher power densities that require more infrastructure within most data centers.

Dive Insight:

AI requirements are changing data center infrastructure, pushing power densities to 50 kilowatts to 100 kW per rack. As a result, many colocation providers are finding they can reduce initial power delivery costs for high-density clusters, JLL said.

“The amount of data has grown by 20% a year. We need more data centers to store all of that data. So, facilities managers are finding more and greater volumes of data in greater scale, combined with greater density of storage, which creates more heat and more mechanical load. And that creates more points of failure because there are more devices to manage,” Sean Farney, vice president of JLL’s Americas data center strategy, said in an interview.

JLL’s report named Phoenix and the Northwest as two of the top six North American primary data center markets in the first half of the year. Those two markets have outpaced Northern Virginia, with absorptions of 194.5 megawatts and 185.9 MW from January through June this year.

Since primary data center markets have a limited inventory of colocation space, data center operators have raised prices by as much as 30% year over year, the team wrote. In Northern Virginia, pricing for colocation and shell rents rose 15% to 20% year over year. JLL Research expects that secondary markets such as Columbus, Ohio; Salt Lake City; Austin, Texas; and Reno, Nevada, will continue supporting the overflow from these constrained primary hubs.

Separately, investment bank TD Cowen recently reported that 2.1 gigawatts of U.S. data center leases were signed during the second quarter of 2023 against a backdrop of scarce supply and power. These include Google’s 600 MW deal with a cloud provider in Texas and agreements totaling more than 1 GW signed by Microsoft across Dallas; Chicago; and Leesburg, Virginia, the TD Cowen report said.

Given the increased size and density growth of data centers, the need to minimize errors and failures becomes more critical, according to Farney. “You can’t have a car crash because a data center supporting autonomous vehicles is not working,” he said. Likewise, wearables like continuous glucose monitors cannot be spewing out false readings — the medical information they relay is important, he added.

JLL’s data centers report also highlights the need for additional innovations to improve cooling and energy efficiency that can help hyperscalers and colocation providers meet their sustainability goals. Farney recommends tooling as an approach facilities managers can use to measure carbon footprints and manage aspects like energy usage, air flow and temperature. Tooling is a practice that involves distilling information from large reams of data into bite-sized insights and patterns, which Farney believes can inform better decisions.

The push to reduce costs involved in sustainability upgrades has corporate boards outsourcing facility operations or partnering with external facilities management firms, as that approach can generate fixed monthly operating expenses rather than “unpredictable capital expenses” incurred for sudden upgrades or replacements, Farney noted. Such a model helps data center users stabilize costs and pare back capital expenses, as needed, he said. “We’ve seen this [trend], particularly in the data center space, in the last five to 10 years,” he said