When companies worldwide shifted to remote work during the height of the pandemic, questions arose on how it would affect the office sector.

Now, three years later, some signs point to an office comeback. After all, commercial planning, which includes office projects, increased 7% year over year in May, according to the Dodge Momentum Index. Meanwhile, spending on commercial construction, albeit led by warehouse and retail, remains up 23.7% over the past year, according to Associated Builders and Contractors analysis.

But it looks like tech giant Amazon isn’t banking on that data.

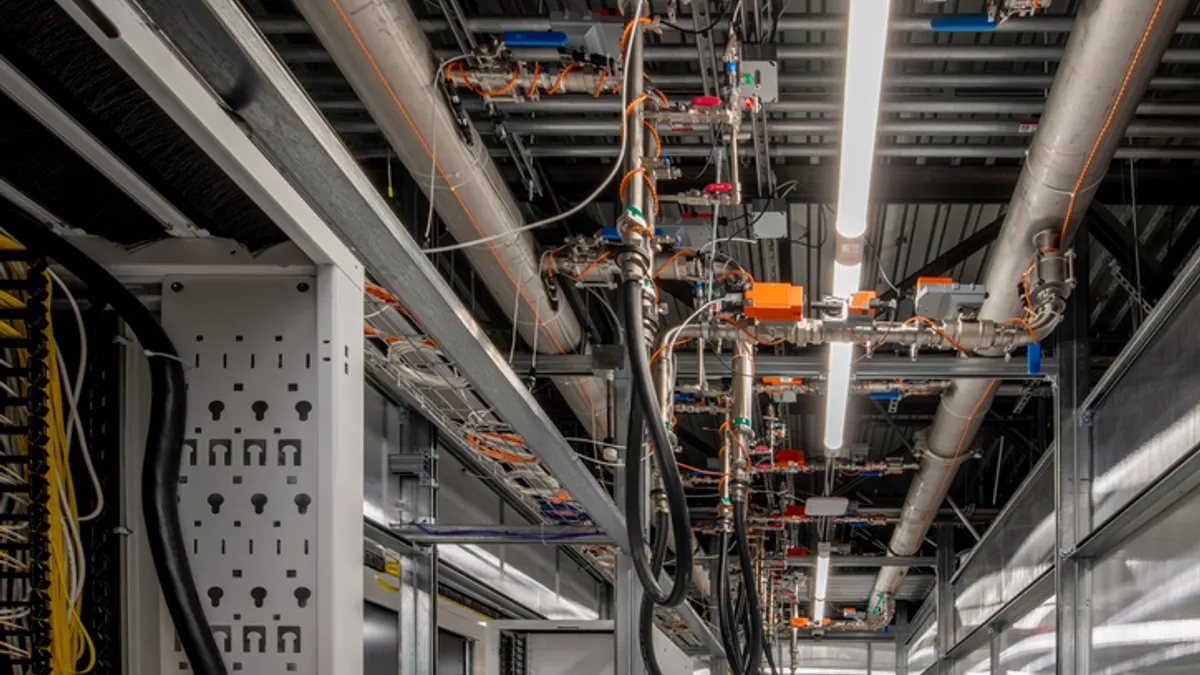

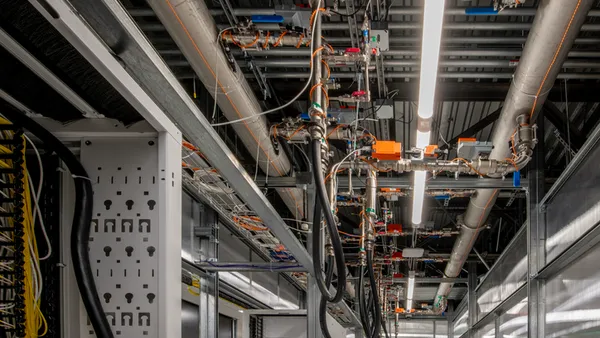

Earlier this month, Amazon filed plans in Sterling, Virginia, to demolish nine office buildings across three sites to create space for four data center facilities, according to Loudon County, Virginia, land applications accessed by Construction Dive. Amazon acquired the three office complexes at the Loudon Commerce Center over the past year, all within walking distance, in order to make way for the new data center campus.

The project is part of Amazon’s continued growth in Sterling, according to an Amazon Web Services spokesperson. Since 2006, Amazon said it has invested more than $35 billion in projects in Virginia, the largest data center market in the world.

Amazon isn’t alone in its strategy to convert former offices into other building types, said Jessica Morin, director of U.S. office research at CBRE.

“Since the pandemic, people have placed more importance on the quality of their working environment and tenant preferences have shifted,” said Morin. “We will see increasing obsolescence of office buildings that are outdated in less desirable locations.”

Public and private developers are evaluating how to transform vacant office buildings for new uses including residential. That will inevitably lead to conversion or demolition, she added.

“Historically high vacancy, rising interest rates and a tight lending market are deterring developers from breaking ground on new office projects,” said Morin. “As projects under construction are delivered over the next several quarters, completions should slow dramatically by mid-2024.”

A booming sector

Construction starts in the first quarter of this year fell 67% from the quarterly average from 2000 to 2019, according to CBRE data. Meanwhile, CBRE Econometric Advisors predict the average quarterly office completions will fall to just 4 million square feet from the second quarter of 2024 to the fourth quarter of 2028. That will eventually reduce supply-side pressure on the vacancy rate, said Morin.

On the other hand, data center construction is booming, said Richard Branch, chief economist at Dodge Construction Network. Data center construction, which forms part of Dodge’s overall office category, now accounts for roughly 30% of the dollar value of office construction starts.

Corporate headquarters and campus projects like the $600 million Mutual of Omaha office tower, also appear to be “holding up well,” said Branch. Still, office projects that are built for rent, the largest portion of office construction, are showing “considerable weakness” with an equally dire outlook as remote and hybrid work trends show few signs of slowing down. That suggests a longer structural pullback in office starts, he added.

“There has been little to no movement in remote and hybrid work trends over the last several months and while some CEOs are making headlines by mandating a return to the office, many more are finding those mandates hard to stick to,” said Branch. “The labor market currently favors employees, and more employees are demanding remote or hybrid work options.”

Weaker demand for office space due to recession fears and hybrid work arrangements, in addition to the delivery of new supply, has pushed the office vacancy rate to a 30-year high of 17.8%, according to CBRE data.

Nearly 44% of real estate executives with U.S. office portfolios reported portfolio contraction since the start of the pandemic, according to CBRE’s 2023 Spring occupier sentiment survey. Over the next three years, 53% of respondents anticipate further contraction of their office portfolio, with as much as a 30% decrease.

Still, Branch remains optimistic the office market will rebound in the long term.

“The office sector is likely to evolve instead of melt, much like how retail space did as sales shifted online,” said Branch. “I don’t think the final chapter of the office market has been written yet.”