Dive Brief:

- Office utilization rates in the Americas still lagged behind pre-pandemic averages in 2023, averaging a 31% utilization rate across all business sectors compared to the 64% pre-pandemic global average, according to CBRE’s 2023-2024 Global Workplace & Occupancy Insights report.

- With square footage per person falling and space sharing increasing worldwide, the average global occupancy, or number of people assigned to a number of seats, has surpassed 100% for the first time ever, the report states.

- Forty-three percent of organizations globally plan to decrease their portfolio size by more than 30% in the next three years, CBRE said. Companies are using new performance metrics like utilization rates and employee sentiment instead of older ones, like square feet per seat, to make space decisions, the real estate services firm noted.

Dive Insight:

The report, which examined 66 global clients across 5,808 buildings representing almost 350 million square feet of space, examined trends across office occupiers that included remote work, the supply and demand of space, portfolio optimization strategies and workplace experience measurement. Despite companies using progressively more efficient portfolio and space planning, the combination of hybrid work and underutilized office space has led to an imbalance of office space, CBRE said.

The decrease in average office utilization suggests that office attendance has plateaued, the firm said, thus it believes the imbalance will not resolve without “well-communicated changes” to hybrid policies, further reductions in portfolio size or workplace experience improvements that attract employees to the office.

Over the last three years, hybrid work has led building owners to reduce their portfolios and operators to find planning efficiencies, CBRE said. The average square footage per person fell 22% in 2023, driven in part by a 44% increase in collaborative space globally since 2021, CBRE said. Since January 2020, 62% of survey participants said they reduced their office portfolio size, with an additional 63% expecting to make further reductions by 2026.

Just 29% of overall respondents said they plan to expand their portfolio in the next three years, but organizations with less than 12 million square feet of space, which did not reduce much space in the past three years, are planning more significant reductions in the near future, the report noted.

Of the firm’s clients that plan to optimize their portfolios, 75% said they plan to cut underutilized space and 82% plan to increase space-sharing, while 67% said they will accommodate headcount growth in the existing portfolio.

To prepare for this new level of collaboration and space-sharing, commercial real estate teams plan to increase the use of “micro level utilization data” — gathered through sensors and network activity — to measure employee work styles, reduce occupancy costs per visit and dynamically manage buildings, CBRE said.

The report predicts that commercial real estate leaders will need to create a new scorecard that combines CRE data with HR, finance and IT to track the workplace’s impact on employee performance, operational priorities, financial goals and ESG objectives.

While traditionally office capacity was based on the number of desks and offices that could be assigned to people for focus work, the report states that today’s hybrid employees are more likely to share a variety of space types for collaboration and focus throughout the day.

To understand the full planning opportunity that hybrid work provides, organizations must plan for alternative work seats, spaces other than desks where employees can work comfortably for an extended period, CBRE says. By including alternative work seats in their capacity calculations, building leadership can measure hybrid workplace performance and planning efficiencies more accurately, as these seats account for the space where collaboration occurs, it says.

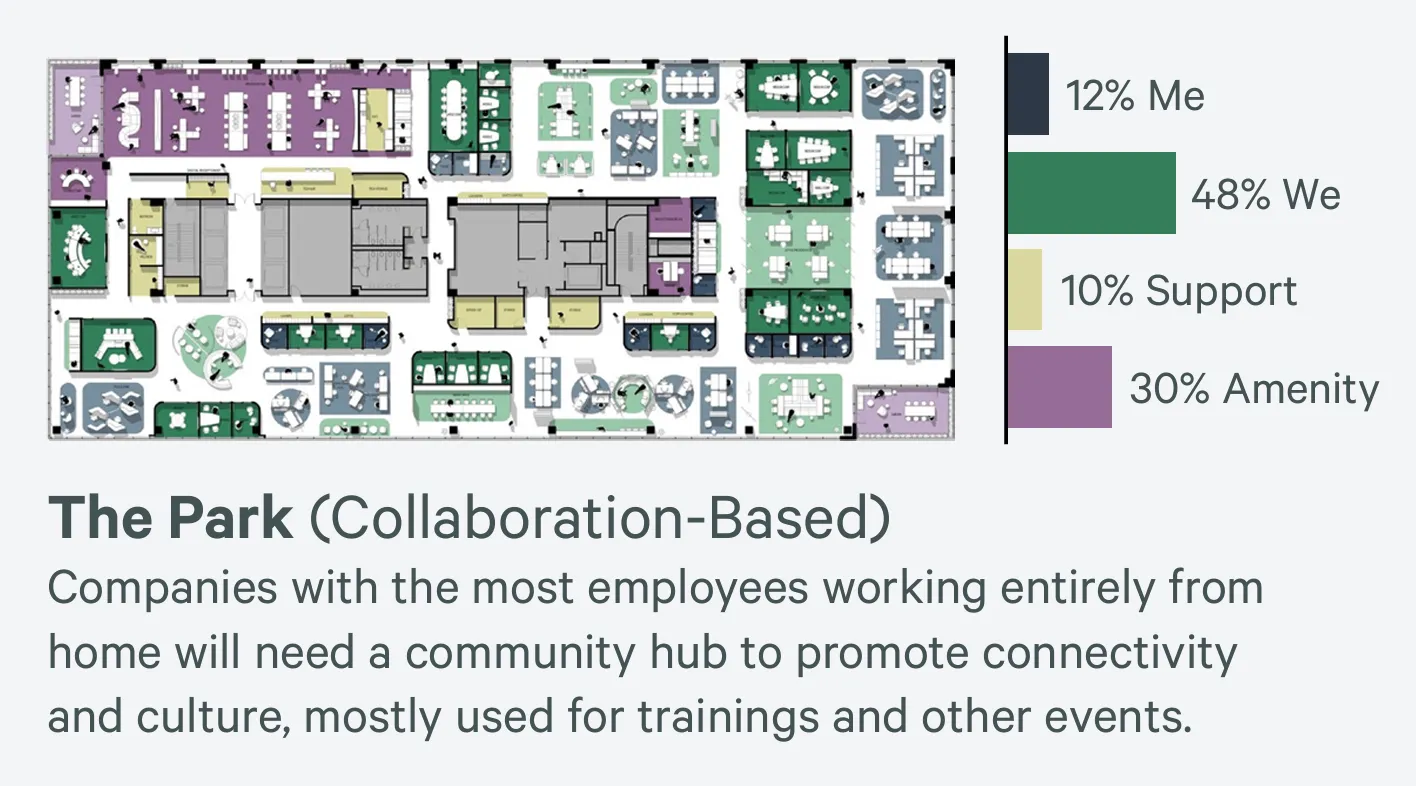

The report provides four new office design concepts that incorporate current collaborative, sustainable and flexible work trends: the Boulevard, a focus-based arrangement of seats where one major thoroughfare connects curated collision points; the District, an activity-based setup where employees share desks and organize where and how they want to work; the Plaza, an event-based model that allows a higher proportion of collaboration space; and the Park, a collaboration-based hub mostly used for trainings and other events.