Dive Brief:

- Although large commercial buildings receive the most climate-aligned investments and capital, there is a growing need for such investments to target small and medium-sized commercial buildings to meaningfully reduce carbon emissions in the U.S. real estate sector, says RMI, an organization that works with businesses and policymakers to decarbonize energy systems.

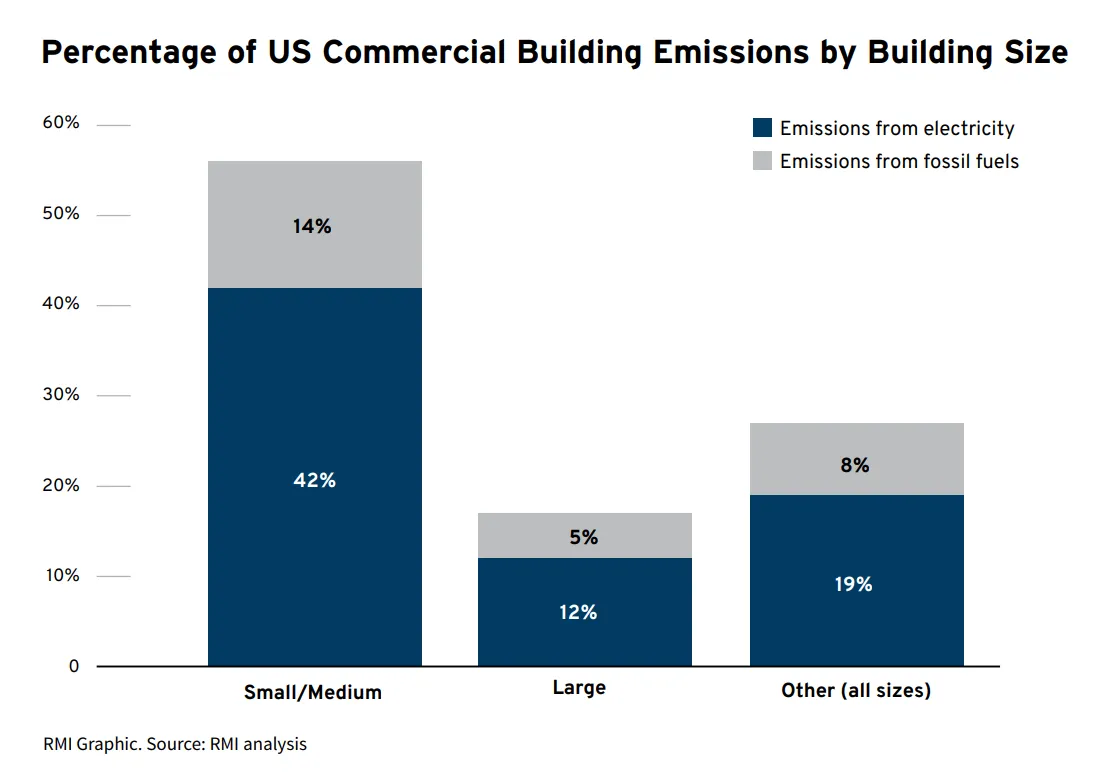

- Building operations account for 23% of annual carbon emissions in the U.S., with a majority of those emissions coming from existing buildings, according to RMI’s March 2024 report on financing building decarbonization. Commercial buildings generate 37% of U.S. building emissions, with small and medium-sized buildings contributing about 56% of those emissions, the report says.

- Investors, lenders and regulators can ramp up decarbonization efforts by channeling financial resources toward retrofits that can boost energy efficiency in existing buildings, RMI says.

Dive Insight:

Pressure to decarbonize buildings is intensifying, with investors and lenders increasingly on the lookout for buildings that have attained recognized sustainability certifications. However, financial barriers exist, with existing smaller buildings less likely to attract capital or financing from investors and lenders, compared to larger enterprises or new builds, RMI notes.

The report recommends that lenders conduct, as part of their underwriting process, a cost-benefit analysis of efficiency upgrades and the replacement of fossil fuel technologies with renewable ones. Lenders must also allow replacement reserves to be used for deep efficiency upgrades, while incentivizing energy performance improvements by offering inefficient buildings lower rates or improved terms contingent on energy improvements, the report notes.

RMI says its study used average grid emissions factors from the National Renewable Energy Laboratory’s 2022 version of Cambium — data sets containing modeled hourly emission, cost, and operational data for a range of possible futures of the U.S. electricity sector through 2050 — at the national and state level. Roughly 396 million tons, or 73%, of the 540 million tons of commercial buildings’ carbon footprint come from electricity use. Fossil fuel use contributes nearly 27%, or 144 million tons, the report says.

When breaking down these emissions by subsegment and size, RMI found that medium-sized education and small food service buildings are significant contributors, accounting for 3.9% and 2.7% of overall emissions in the U.S., respectively. Medium-sized mercantile, or strip malls, also generate significantly more carbon than its percentage of U.S. real estate floor area would suggest, contributing 4.5% of overall commercial building emissions, compared with the 2.5% of floor space it makes up in the sector.

Buildings categorized as “other,” spanning storage facilities, crematoriums, labs, data centers, broadcasting studios and manufacturing and industrial facilities, contribute 10% toward operational building sector emissions, RMI’s report states, followed by offices and mercantile, which each account for 6%, and education facilities, which represent 5%. These findings point to small and medium-sized commercial buildings representing over 20% of total U.S. building emissions. Among small and medium-sized commercial buildings, emissions from electricity contribute 42% to U.S. commercial building emissions, while emissions from fossil fuels account for about 14%.

Large commercial structures of more than 200,000 square feet, in contrast, tend to produce lower emissions. They represent only 17% of commercial real estate emissions or 6% of total building emissions, with electricity emissions accounting for 12% of U.S. commercial building emissions and fossil fuel use contributing around 5%, the report states.

Commercial buildings with poor energy efficiency should get access to financing, RMI notes, emphasizing that lenders should work proactively with borrowers to replace fossil fuel-powered systems with higher-efficiency electric systems.

Removing financial barriers to accessing sustainability solutions is possible, said Travis Sheehan, North America lead for City & Hubs at Shell Energy, pointing to subscription options that involve initial investments in building efficiency improvements from energy solution providers.