The pandemic has permanently altered how many people interact with the workplace, with the rise of remote and hybrid work increasing the importance of flexible spaces and driving an increase in the number of coworking spaces, according to Yardi’s Q3 National Office report.

As some companies work to push all workers back into the office, others have decided to lean into coworking. Insurance company Allstate Corp., for example, is opting to provide flex space accommodations to a quarter of its 54,000 corporate employees in cities including Atlanta, Indianapolis, Minneapolis, and Tampa, Florida, Bloomberg reported Nov. 18. After cutting two-thirds of its office space and selling its Chicago headquarters, Allstate is now allowing some employees to book offices by the day through coworking platform LiquidSpace and allowing others to work in traditional leased space that has been renovated with cafes, quiet libraries and event spaces, according to Bloomberg.

The total number of coworking spaces grew 7% quarter over quarter, to 7,538 in the third quarter, according to Yardi’s report. Total space attributed to coworking also grew about 4.5%, or more than 5 million square feet, to 133.5 million square feet, with shared space recording a 1.6% penetration rate in the overall office market.

Even as the total number of coworking spaces has grown consistently in recent years, the average size of coworking spaces shrank from 18,132 square feet in the second quarter to 17,711 square feet in Q3, Yardi says. Average coworking size in the quarter dropped in 15 of the top 25 markets Yardi analyzed, per its report.

“We expect this trend to continue, as smaller spaces open, serving niches and more localized communities, replacing the centrally located, large-scale, multi-floor flex spaces that were prevalent before the pandemic,” Yardi says.

The average coworking membership for 10 employees is more affordable than the equivalent office lease in more than 97% of the 102 cities analyzed by CoworkingCafe. A market study published by the digital flexible workspace platform in September notes that coworking memberships cost less than half of traditional office leases in 17 of the 20 cities with the largest price gaps between coworking memberships and traditional office leases.

The top coworking space operators — Regus, HQ, Vast Coworking, WeWork, Spaces and Industrious — account for nearly 25% of all flex spaces and more than 33% of all square footage, according to Yardi’s report. Regus is by far the largest operator, with more spaces than the next five top operators combined, Yardi says.

U.K.-based International Workplace Group, which owns the Regus, HQ and Spaces brands, reported a 46% year-over-year increase in managed and franchised fee revenue in Q3, ending the quarter with 169,000 open rooms and a pipeline of 173,000 rooms signed but not yet opened, IWG said in its earnings report released earlier this month. IWG said new office openings “continue to accelerate”, growing 52% year over year in the third quarter amid workers returning to offices this year, City AM reported.

Pointing to Vast Coworking’s acquisition of Intelligent Office and its partnership with WeWork earlier this year, Yardi says it expects consolidations and strategic partnerships to continue expanding and evolving as the sector adapts to post-pandemic work. Through its agreement with Vast Coworking, WeWork will make its booking software available at Vast franchises, adding locations that its members can access.

Los Angeles had the most flex spaces in the U.S. in the third quarter with 292, followed by Dallas-Fort Worth (279), Manhattan (275), Washington, D.C. (266), and Chicago (255), Yardi says. Chicago offers the greatest cost-cutting opportunity, with almost $25,900 in potential annual savings when moving a small team from an office lease to a coworking membership, according to CoworkingCafe’s report.

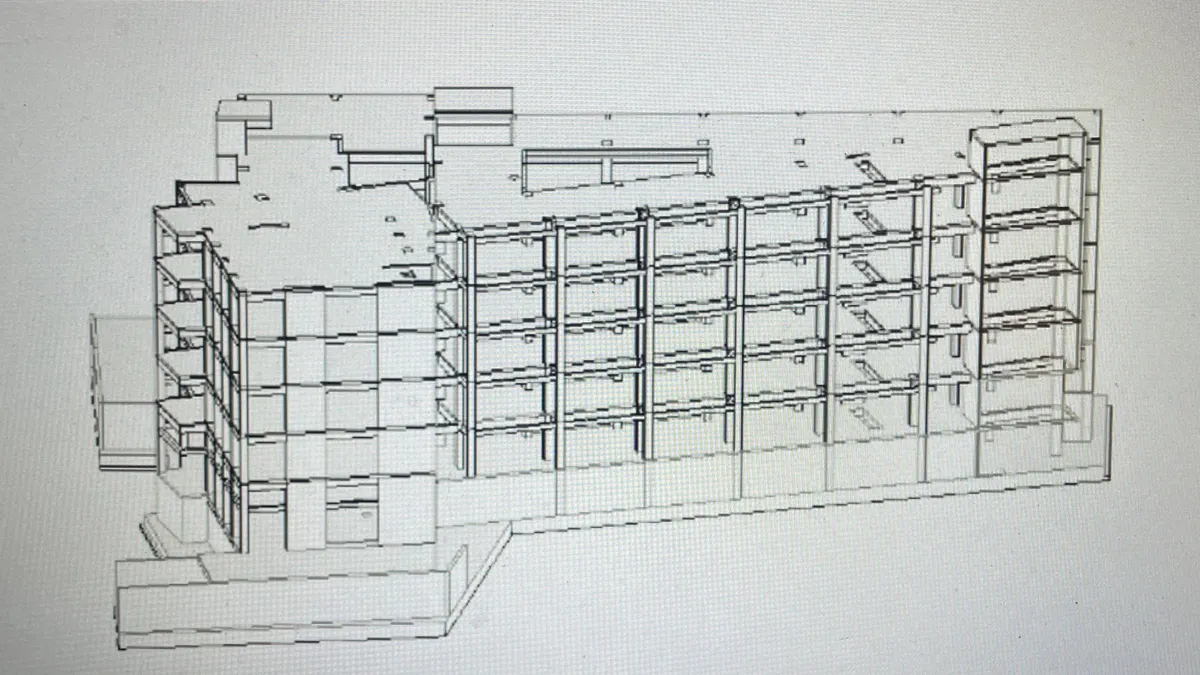

TeamWorking by TechNexus, a shared workspace located in Chicago, recently became the city’s largest coworking space as a result of a multifloor expansion at the historic Civic Opera Building. JLL represented TeamWorking in the expansion, according to a Nov. 13 news release. The coworking space provider now operates over 100,000 square feet of suites, offices and event space at 20 N. Wacker Drive after entering into a management partnership agreement with the building, it said.

The national price of coworking locations remained stable in the third quarter, with dedicated desks staying level at $300 per month, Yardi says. Open workspaces and virtual offices increased slightly, to $150 and $120 per month, respectively, according to its report.