Dive Brief:

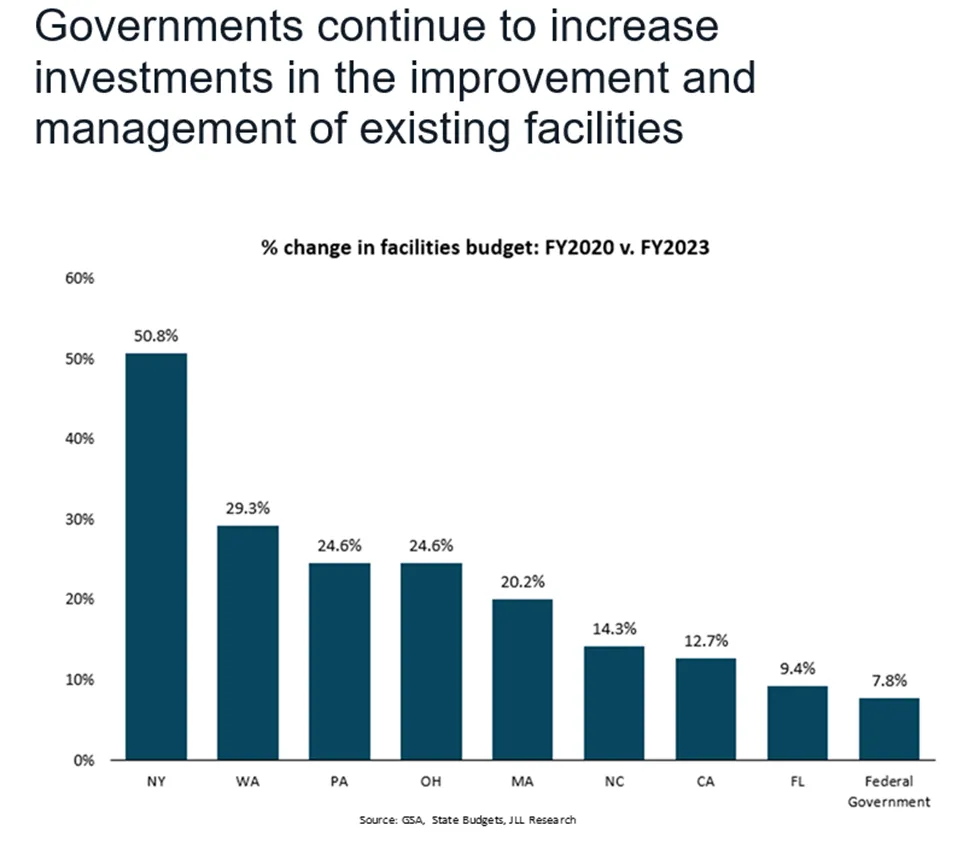

- Budgets for federal government facilities have increased just 7.8% from 2020 to 2023, compared to more significant budget increases in a number of states, according to research from JLL emailed to Facilities Dive.

- That 7.8% increase compares to budget increases of 50.8% and 29.3% in the states of New York and Washington respectively, with Pennsylvania and Ohio both seeing a budget increase of 24.6%.

- JLL said federal agencies will need to improve existing facilities and add amenities to compete with the private sector, as employees return to office.

Dive Insight:

These upgrades are additionally important at the moment, with return-to-office mandates currently affecting both space and labor decisions for federal employers.

Due to continuing policy shifts, 1.5 million office-based U.S. employees have had new attendance policies take effect in 2023, according to JLL’s Q2’ 2023 U.S. Office Outlook report. The mandates are set to affect an additional million by year-end, based on announcements so far.

Seven federal agencies have announced return-to-office plans in the past three months. About 26% of federal employees reportedly considered leaving their jobs based on hybrid work options, according to the U.S. Office of Personnel Management’s 2022 Federal Employee Viewpoint Survey.

Federal agencies are already at a disadvantage when it comes to their facilities. The average age of office buildings in the government’s owned portfolio is 37.5 years, JLL said. The firm noted that civilian agencies have additionally deferred $76 billion worth of real estate repairs.

As a result, tackling these repairs and space upgrades will be crucial to the public sector, JLL said. Funding for facilities’ upgrades is available in some states, however, with New York, Washington, Pennsylvania and Ohio increasing their budgets by at least 24%. These states are followed by Massachusetts (20.2%), North Carolina (14.3%), California (12.7%) and Florida (9.4%).

JLL’s report also pointed to intense demand for new space, at least in part due to return-to-office mandates and the need to attract employees into the office, resulting in landlord-favorable conditions in top-quality segments and tenant-favorable conditions in lower-tier buildings.

“Certainly, the government has some old, dilapidated buildings, and they've gotten a lot out of them. We take care of many of them in that process, and there's more work that goes into that,” Kevin Wayer, JLL president of government, education, infrastructure and life sciences, said in an interview with Facilities Dive.

Wayer noted that older buildings use more energy, compared to newer construction, adding, “We're in a process of a time period — call it 10 years — where I think these portfolios will start to right size themselves, and the ultimate use of those assets will come to fruition.”

A recent U.S. Government Accountability Office report found that a majority of federal agencies use less than 25% of their headquarters’ building capacity. The same report pointed to budgetary concerns, revolving around the need to reconfigure buildings to support hybrid office dynamics, as agency leaders’ biggest roadblock to effectively utilizing building space.

Concerns about the future of in-office attendance policies and a reluctance to share headquarters space with other agencies were also listed by the GAO as key impediments for federal agency officials.