The life sciences industry may conjure up a vision of cutting-edge research labs teeming with scientists in lab coats. While research is a key focus area, the discovery of new treatments and biomedical innovations involves facilities with extensive support infrastructures that enable specific technologies and build on expertise.

In addition to standard duties such as maintenance and staffing, facilities managers in the life science space deal with a heightened level of rigor as it pertains to manufacturing processes, sanitation practices and safety requirements.

"We're in the business of maintaining highly sensitive spaces," Kevin Wayer, president of JLL’s work dynamics, life sciences group, told Facilities Dive. The company also oversees corporate campuses for large pharmaceutical and biotech companies.

Wayer noted this work means ensuring these facilities and its workers embrace Good Manufacturing Practices, meaning systems that ensure products are consistently produced and controlled according to quality standards, and Good "x" Practices, which describes the guidelines applied in the pharmaceutical industry.

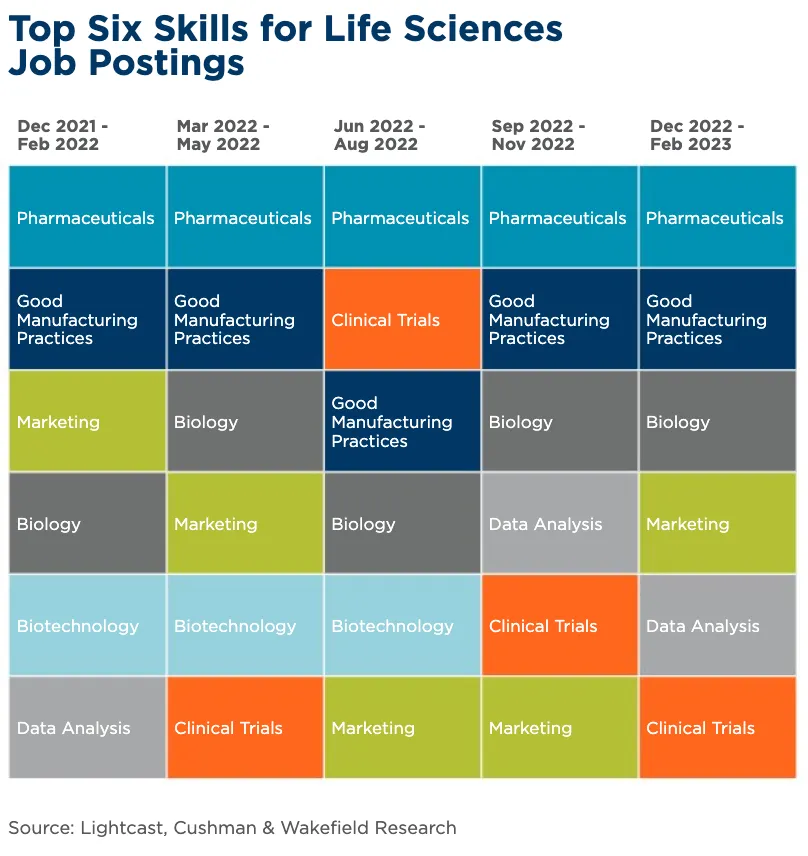

The need for GMP-specialized services is evident in the skills that life sciences firms are hiring for, with Good Manufacturing Practices ranking as the second most sought-after skill in the industry based on job postings, according to Cushman & Wakefield’s March 2023 Life Sciences Update.

Since the beginning of the year, there has been reduced global venture capital funding, further adding pressure onto life science facilities managers to undertake cost-efficiency measures in their operations. Those challenges coincide with a dip in private equity investments, which declined 24% year-over-year to $37.3 billion in March.

“There’s a lot of cost and efficiency pressures that our colleagues and clients are navigating through right now,“ said Ron Chisolm, senior vice president of client services for Cushman & Wakefield Services’ life sciences portfolio. In a previous interview with Facilities Dive, he emphasized the need for more innovation to strengthen his team’s capacity to assist clients with achieving their goals.

A key area that intensifies the industry’s pain points is labor and talent. Chisolm believes that achieving consistency in the labor pool is more important than base wage costs due to a shortage of qualified labor in the life science service space, heightened in part due to GMP requirements.

Massachusetts, which houses one of the nation’s largest life sciences hubs in the Boston and Cambridge areas, found that there are not enough workers to meet the volume of life sciences job openings. According to the state’s 2023 Life Sciences Employment Outlook, 24,394 research scientists were employed last year, followed by 20,570 management professionals who accounted for the second largest segment of employment in the space.

While the state projects more than 6,600 average annual job openings in key life sciences occupations over the next decade, it says the average annual supply from its education institutions amounts to filling just half of those roles.

The employment outlook also pointed to a 37% growth in production and manufacturing jobs since 2019, after years of job declines in the area. Earlier this year, MassBio, one of the nation’s oldest biotech trade associations, created a nonprofit aimed at training and upskilling workers, saying it hopes to mitigate the pervasive impact of a “facilities labor crisis” in the industry.

These challenges come on the heels of record growth and employment in the U.S. life sciences industry over the past few years, which have only started to normalize recently, according to CBRE’s 2023 U.S. Life Sciences Outlook. The demand for lab and R&D space, however, remains “well above pre-pandemic levels.”

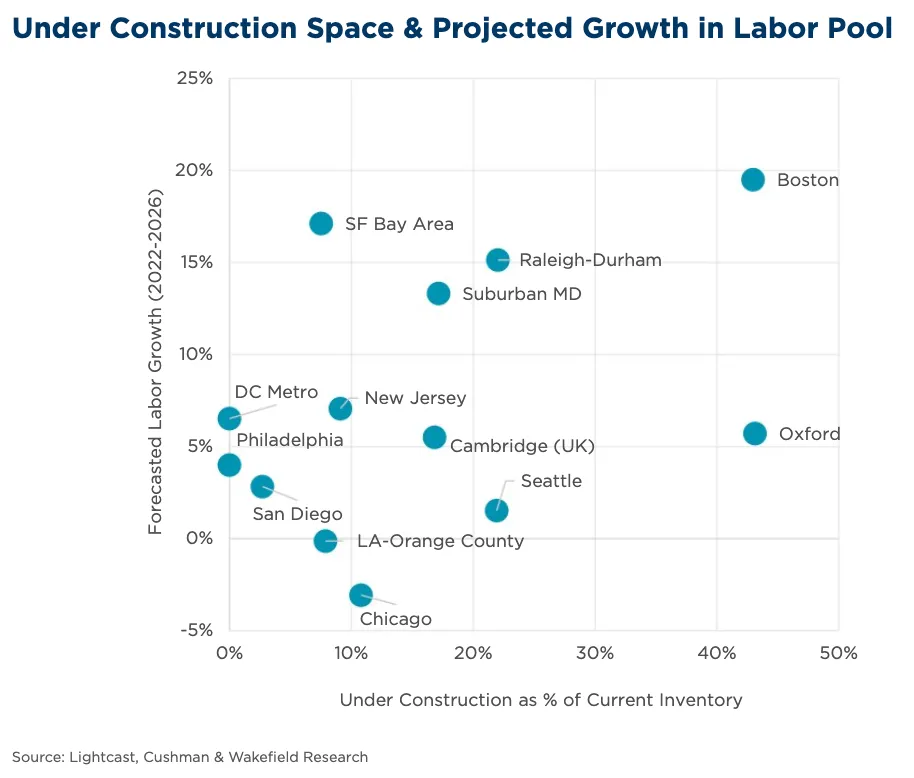

Even as other commercial real estate segments struggle to retain tenants, with vacancy rates reaching record highs in numerous cities, the demand for life science facilities has continued to surge in regions like Boston, Cambridge, Seattle and the San Francisco Bay Area.

“The ecosystem of the life science market is not going away,” Wayer said. “There are ebbs and flows and cycles to everything. We’re certainly coming out of one with a lot of money being spent, particularly around the pandemic needs.”

CBRE forecasts over a 20% climb in life sciences lab and R&D space over the next two years due to all-time volume in new construction currently underway. Cushman & Wakefield said the sector’s development pipeline has more than doubled in the last three years, including almost 32 million square feet in development at the end of 2022. This construction pipeline is expected to comprise 17% of total U.S. inventory, compared to just 6% in 2019, according to Cushman.

Not all of that space is expected to be filled, however. The firm predicts this will moderately increase life science vacancy rates, but said these vacancies are still substantially below their long-term average.

Cushman & Wakefield noted that despite a 9.2% rise in overall U.S. life sciences vacancy rates year-over-year, rates remain low in most markets, with nine of 15 major markets falling below 10%.

Further, CBRE highlighted the ongoing rise in rents, with life sciences pricing remaining high due to record-low cap rates and “robust investor sentiment.” CBRE noted that despite industry investment sales volume returning to pre-pandemic levels, due to uncertainty on whether an economic recession occurs, the life sciences industry is more immune to these headwinds than other sectors.