Dive Brief:

- Life sciences laboratory space availability has significantly increased across the U.S., with the highest concentrations in the Boston and San Francisco Bay areas, according to a report from JLL.

- With supply peaking, the current market favors tenants, particularly smaller ones, it notes. But lab space demand is set to rebound, following a period of slowdown, driven by increasing confidence in biotech by leading venture capital firms and their anticipated investment growth in 2024, the firm’s “2023 Life Sciences Industry and Real Estate Perspective” report notes.

- “Businesses are beginning to make that turn,” Pam Paddock, managing director of life sciences business at JLL, said in an interview. “As all of these drugs and technologies are coming toward post-incubator [status], there's a lot of activity around acquisitions of smallish spaces. And those smaller spaces need a scaled delivery. They really need everything that a big entity needs, but they need a scaled-down, very cost effective delivery model.”

Dive Insight:

The pipeline of lab space is likely to slow as completed projects are expected to surpass new project starts in the coming years, the report states. JLL expects downward pressure on base rents and occupancy in top markets in the short term, before supply begins to mediate at the end of 2024.

At the same time, the company expects demand to grow, as it sees positive signals in venture capital investment in biotech. Top life sciences VC firms have raised a record amount of money, which the report says will soon find its way to growing startups. Mega deals for companies with strong clinical data are likely to continue in the short term, with material investment gains expected in 2024, it adds. JLL’s report also points to life sciences job openings as a sign of growth to come: New jobs grew substantially in the second quarter of 2023, with May and June in the top six for monthly job openings on record. Many of these openings are for highly specialized research scientists and C-suite executives.

Opportunities exist for tenants and landlords now, despite a challenging environment, with smaller tenants in a position to negotiate economically favorable transactions and shorter lease commitments with low amounts of capital, the report says.

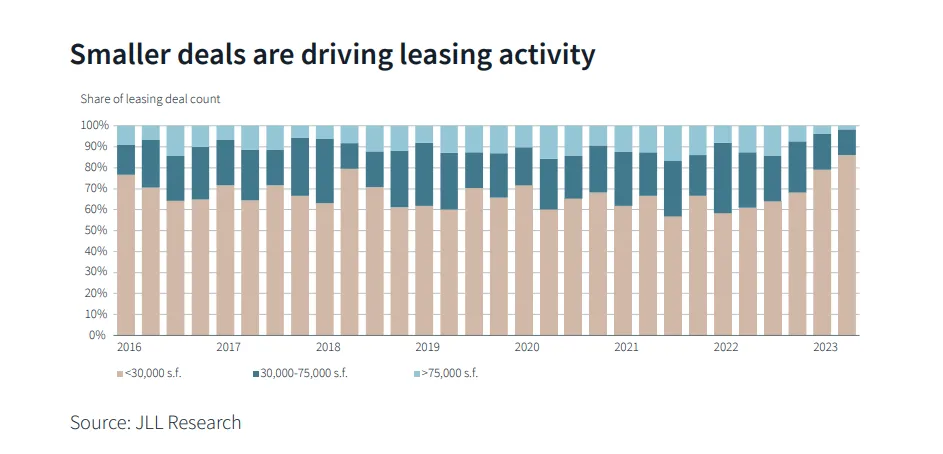

Demand for space has changed considerably in the past 18 months, falling from over 25 million square feet across the top eight U.S. markets in the fourth quarter of 2021 to just over 10 million square feet in the second quarter of 2023, JLL says. Smaller companies that have “a critical need for bench space, as opposed to mid-to-late-stage companies [that] can make do with their current situations,” are now the majority of users seeking space, with sub-30,000-square-foot tenants accounting for 82% of the deals signed in the first half of 2023.

For a landlord, “it's about being in there and delivering to and for these very small entities in their post-incubator [stage], until they know what their future is,” Paddock said. “We do that by assuring them that all of the elements of a bigger delivery, from a lab tech to a facility manager to an operations manager, are grown and added.”

Smaller tenants can sometimes share facilities staff resources until they are ready to move into a new space, she noted. “That's an opportunity to do that scaling. You're not trying to make one person do five different jobs. That's really a dilution of someone's skills, and you don't get the best of the best. But by really letting people focus on what they do, and maybe letting them do that in more than one place until an entity gets bigger, that's the way to get the opportunity and the true value out of service delivery,” she said.

Laboratory space in life sciences requires specialized and regulated procedures and policies. There is a high demand for trained facilities employees that can support the “science as it's happening,” she said. Paddock noted that the sector has a large list of additional requirements for workers, in addition to the common challenge of finding qualified field service technicians. “There's a lot of paperwork, if you will, that has to go along with all of that. Making sure that the talent is properly trained. It might all look like HVAC techs and electricians, but there's this very deep level of added complexity and requirement — gowning, for instance, and going into a clean room,” Paddock said. “People have a lot of responsibility, and then all of the offshoots of maintaining that: the garment collection, and the masks and the other parts and pieces that surround those spaces.”

JLL works to develop relationships with feeder schools in key markets to recruit talent that can serve the sector’s field service and facilities management needs, Paddock said. She also underscored the importance of creating a loyal workforce and paying attention to the “people aspect of what we do every day.”

“What do people need? Are they getting what they need? It's really about having a group of people who are agile, in the background, meeting those needs, and trying very hard to keep the talent in place,” Paddock said. “We have to think about that every day because there are lots of challenges and lots of tugs in these markets for this kind of talent.”

Correction: A previous version of this article misstated the author's name. The author is Joe Burns.