Almost four years after the start of the COVID-19 pandemic, more organizations are leveraging occupancy data and employee preferences to inform workplace space decisions and building operations as companies urge their workers back to the office.

Thirty-three percent more companies across North America said in December that they plan to encourage more time in the office compared with six months ago, with 25% saying they plan to require more attendance, according to VTS’ 2024 Global Workplace Report. Workplace management and analytics firm Robin echoed this sentiment late last year, finding in a survey of over 500 facilities managers and business owners that 88% plan to mandate that employees work a certain number of days on-site.

Hybrid work environments dominate workplace operations

Even as executives express a stronger desire for employees to return to the office, the lingering effects of the COVID-19 pandemic and preferences for flexibility have led hybrid work to dominate the landscape in 2024, VTS said. Fifty-two percent of organizations require employees to come into the office between one and four days a week, compared with 37% that require in-office work five days a week, according to the report, which surveyed over 400 business leaders worldwide.

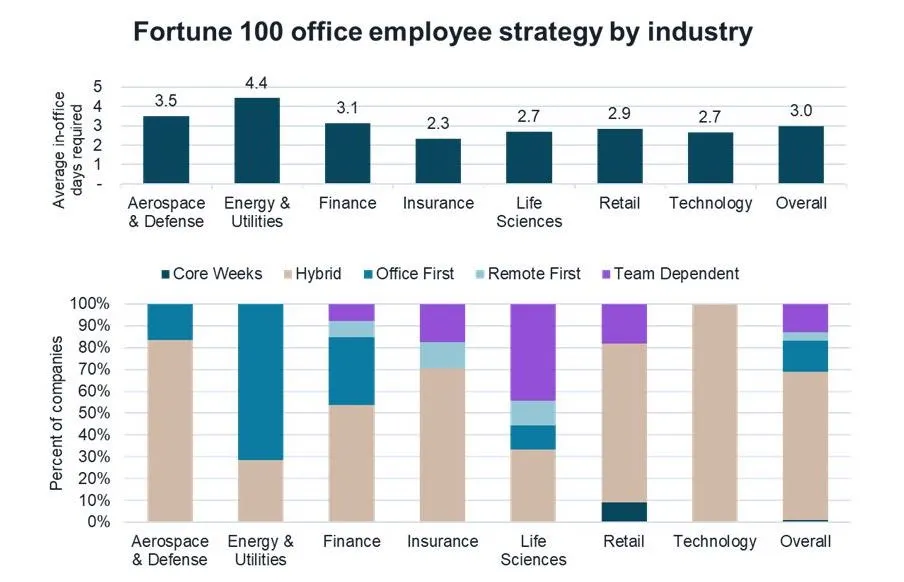

New JLL Research data shared with Facilities Dive reports that 68% of Fortune 100 companies have landed on a hybrid strategy for their employees in the near term, averaging three days on-site per week.

The push for a greater return to the office is already affecting how business owners and facilities managers address their portfolios, assets and operations. Office work largely was done on-site before the pandemic, remotely at the height of the pandemic, and now as a hybrid of the two.

What has been driving change to the work model in the past year? According to a late 2023 survey of 549 business leaders by FM:Systems, 53.8% attributed work model changes to management mandates, 43.9% pointed to initiatives that incentivize employees to spend more time in the office, and 28% said office layout and decor adjustments they’ve made in the past year. Robin’s November 2023 office space survey found that 89% of respondents are changing their office layout or design to support new employee demands.

“The No. 1 thing we see driving [return-to-office] behavior in general is … the fear of missing out,” Brian Haines, chief strategy officer for FM:Systems, told Facilities Dive. “If your co-workers are in the office and you’re not there, you’re probably missing out.” He noted that this is leading many organizations to shift the way they think about managing their real estate to tilt more heavily toward collaboration space.

The discrepancy between in-office attendance and space utilization

Office utilization rates have remained poor despite moves to optimize hybrid workplaces. According to CBRE’s 2023-2024 Global Workplace & Occupancy Insights report, office utilization rates in the Americas averaged just 31% in 2023, compared with a 64% pre-pandemic global average. At the same time, average global occupancy, or the number of people assigned to the number of seats, has surpassed 100% for the first time ever, it reports, due to a 44% increase in space sharing and a 22% reduction of the average square footage per person since 2021.

While a 20 million-square-foot sample of utilization data by FM:Systems had Haines predict in October a return to pre-pandemic levels of office attendance across the globe by the second half of 2024, CBRE’s more recent report says ongoing decreases in average office utilization suggest that office attendance has plateaued.

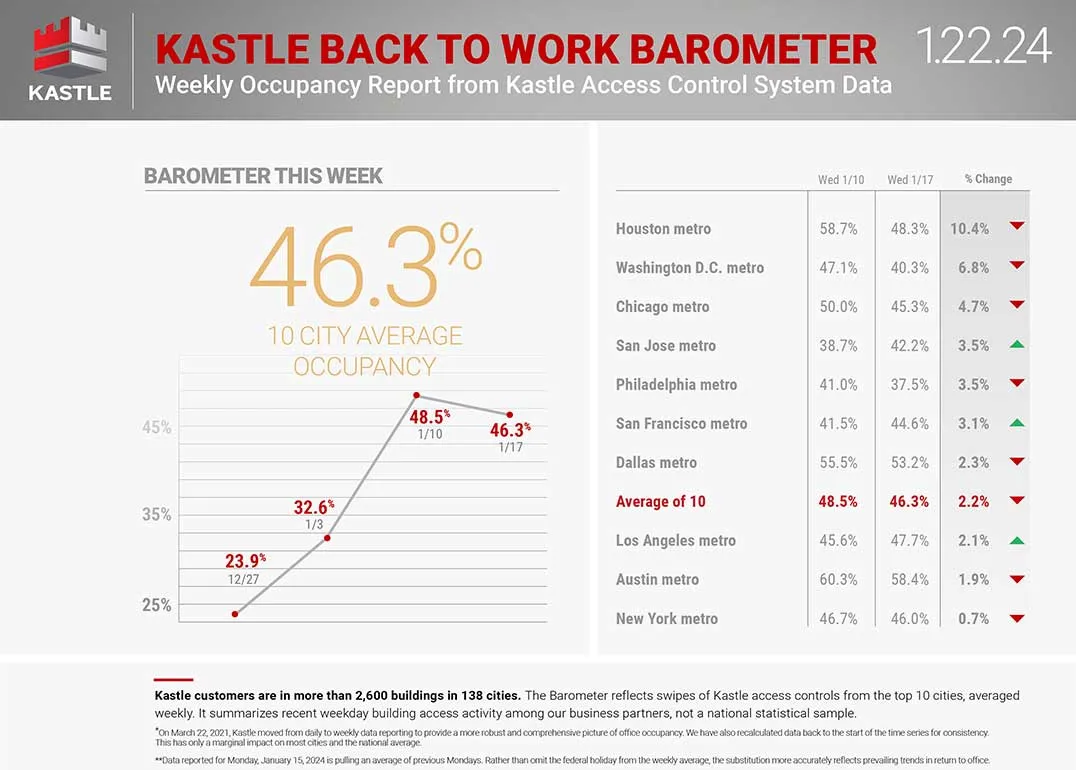

Kastle Systems’ weekly 10-city Back to Work Barometer, which measures average occupancy in 10 major U.S. metro areas across a Thursday-to-Wednesday week, showed its first full measurement period of 2024, which ended Jan. 10, had an average occupancy rate of 48.5% of pre-pandemic levels. This compares with 47.3% in the first week of September 2023 and 44% in the first week of September 2022. Average occupancy rates on the busiest day of the week also rose from 42.5% on Jan. 2 — the first work day of the year — to 57.5% on Jan 9, before falling back to 40.2% on Jan. 16, according to the firm’s Peak Day Hybrid Index, which measures average office occupancy levels on Tuesdays, the day it finds office occupancy typically peaks.

Although companies are adopting increasingly efficient real estate portfolio and space planning measures, hybrid workplace models, combined with underutilized office space, have created an imbalance that gives tenants bargaining leverage, leaving building owners and operators grappling with a need to improve their spaces, CBRE said.

This imbalance will not resolve without purposeful action such as “well-communicated changes” to hybrid policies and amenity-rich improvements that can enhance the workplace experience and draw more employees back to the office, the CBRE report notes.

Further reductions in portfolio size could also partially offset this imbalance, which appears to be a common choice for organizations, the report states. Since January 2020, 62% of CBRE clients across over 5,000 buildings said they have trimmed their office space portfolios; an additional 63% plan to make further reductions by 2026. Globally, 43% of organizations plan to decrease their portfolio size by more than 30% in the next three years, while 20% are aiming for an office space reduction ranging from 10% to 30%, according to the report. According to Robin’s survey, 75% of respondents are planning to reduce their square footage in 2024.

“I would not want to be a commercial real estate broker right now,” said Haines, noting that he expects around 900 million square feet of real estate in North America to come up for renewal in the next few years, as many clients are tied into long-term agreements that do not grant them the flexibility to resize until those agreements end. However, Haines said, numerous internal and external surveys show that the number of companies expressing an intent to increase their real estate footprint is almost equal to the count of those that intend to decrease it. “So, we’re just not seeing a massive dumping.”

While workplace preferences vary across industries and companies, one of the most common concerns is a lack of collaborative space, with 40% of North American respondents in a recent VTS survey citing limited space for team meetings and brainstorming sessions as a pain point in their current office space they hope to address in their next space.

Making space and operations decisions

In order to accurately understand how factors like office layout, indoor air quality and attendance patterns impact efficiency, productivity, costs and employee wellbeing, business leaders and workplace operators are turning to technology for insights that inform decision-making, according to FM:Systems’ January Inside the Workplace report. It found that 69% of organizations use a “workplace management solution,” which it says can work in conjunction with a workplace analytics platform to generate actionable insights.

While the list of hard data sources has grown to include IoT sensors, employee Wi-Fi connectivity, traditional badge swipes and desk bookings fed into resource information systems, building leadership must also look at soft data, which includes how employees feel about their workplace and their relationship with going to work, Haines said in a recent “State of the Workplace” webinar.

JLL Research underscored the importance of aligning work styles with the nature of work for each company to ensure productivity, noting that its data reveals significant variations in average attendance and office attendance strategy across industries. As a result, employee experience data is becoming increasingly instrumental in building operations and workplace management, Rob Kolar, president of JLL Work Dynamics’ technology division, said in an interview.

Kolar noted that building operators need to get their arms around employee experiences, desires and behaviors on a more detailed level. “When people are there, what are they doing? What are the spaces that they're utilizing while they're there, and are those the right spaces? Are there enough of those spaces? Do [those spaces] need to change because of the way people work?” he asked. “I think the mix of what people are doing in the office has changed a lot, so the spaces to map to that kind of activity need to change, too.”

Organizations that have access to accurate workplace data now face the task of leveraging that data to improve space utilization, streamline workplace management and optimize building operations.

Technology firms like Eptura and Envoy offer management platforms that aim to combine workplace experience, space planning, preventive maintenance and visitor management tools. Larger industry players are addressing these demands as well. This is evidenced by CBRE’s $100 million capital investment in and partnership with VTS — providing the real estate services behemoth access to tenant and operator data through a connected mobile application — which CBRE said will give it “the earliest indication of tenant demand versus anybody else in the market.”

JLL Work Dynamics’ Kolar noted that although he has not seen a drastic shift in the amount of amenities that owners and operators are offering occupiers, tenant experience data is playing an increasing role in amenities planning, with teams now able to curate events based on attendance. “When people are in the office — let’s just say it’s Tuesday, Wednesday and Thursday — there may be more offerings than there are on Mondays and Fridays. It’s not going to be anybody’s best move to be offering significant amenities on days when nobody’s in the office.” Kolar said.

In addition to being used for amenities and other soft-operations planning, this data is also playing an increasingly vital role in the way that office operators handle the energy usage of their buildings. Following its acquisition of FM:Systems, Johnson Controls plans to leverage the workplace insights its software provides to boost efficiencies in buildings through automated controls and operations management.

“We've solved the utilization problem, or we’re one of the best in the industry [in doing so]. We are now applying that data to other operations, like all other facility operations, to optimize them based upon how people were using the building,” Haines said. “Integrating that data with the building control systems, we really believe that autonomous building controls are the future and that buildings will be able to greatly exceed performance that had recently been managed by people.”