Dive Brief:

- Rhizome raised $2.5 million in venture capital and launched its climate resilience planning platform today, according to a release.

- The platform calculates economic and social impacts of potential future power grid failures caused by climate change-driven disasters — from storms and floods to wildfires and other extreme weather events.

- The company, which works with utilities across the Northeast and Pacific Northwest, says the ability of its software platform to map out climate risk on the asset level has also drawn interest from real estate and insurance spaces.

Dive Insight:

Strengthening the resiliency of grids has become increasingly important amid a surge of climate-related risks and uncertainties. The U.S. has already been hit with 24 billion-dollar extreme weather-related events this year, the most in a year since records have been kept, according to the National Oceanic and Atmospheric Administration.

Rhizome says the launch of its platform comes as more than $65 billion in funding from the bipartisan infrastructure law is beginning to flow into the grid alongside investments from electric utilities, private companies and municipalities. The software platform helps users optimize their investments in resiliency and mitigate the most risk per dollar through interventions like asset replacements, vegetation management, distributed energy resources and distribution automation devices, Rhizome said.

Until now, infrastructure investment planning has primarily relied on historical data, it said. To help utilities with these decisions, it will use building information to provide high resolution, granular data on grid consumption. The company noted that by pairing resilience research from national labs with infrastructure data and machine learning it can place a “value of resilience” on proposed grid investments.

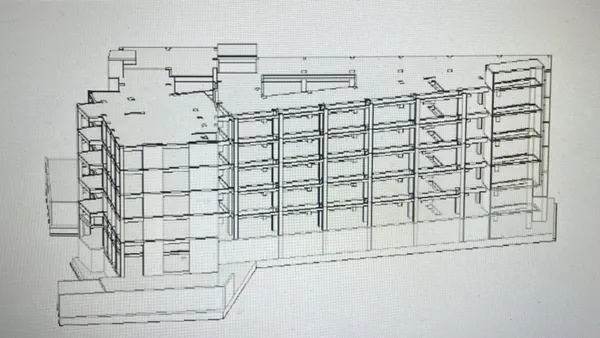

Mishal Thadani, CEO of Rhizome, told Facilities Dive, explained the company’s future plans for buildings and facilities. “We have a climate risk platform, so if you drop an asset — [which is] three-dimensional by nature — you can fundamentally understand financial loss related to the climate threats, 50 years down the road,” Thadani said. “Depending on where they’re located [and] on certain information related to those facilities, [like] how old they are and what the flood plain looks like, you can actually make some really high resolution financial loss calculations there.”

Rhizome says its initial utility partners are located in different geographies on both coasts. “There has been a decent rollout of smart meter infrastructure that has given utilities a lot of insights on consumption on the grid at a really high-resolution, granular level,” Thadani said. “Now, whether or not some facility is collecting data, and let’s say there’s an [application programming interface] that sends that to the utility, it’s still a question [of] whether that data is actually being used or not. But by and large, the use cases are growing.”

Investors participating in the company’s funding include Looking Glass, Intellis Capital, Jetstream, El Cap, Streetlife and Everywhere, according to the release.