Dive Brief:

- With 73 office conversion projects already completed this year and another 30 slated for delivery by year end, 2024 is expected to see the highest rate of office conversions since CBRE began tracking them in 2016, according to a report it released this month. The 103 total projects would be a 63% increase from 2023.

- Office-to-multifamily housing projects account for nearly 75% of the conversion pipeline in Q3, up from 63% in the first quarter, per the report. In contrast, conversions to life sciences buildings have fallen over the past year.

- The report attributes the trend to “historically high office vacancy rates and declining asset values.” It anticipates further growth as cities create incentives for and remove barriers to office conversions and as sellers of distressed assets offer steeper discounts, particularly for older buildings.

Dive Insight:

Since 2016, office-to-multifamily conversion projects have delivered 28,000 multifamily units, with an additional 38,000 expected if all planned projects are completed, according to the report. The conversion of largely vacant office buildings is helping cities turn certain neighborhoods into “thriving economic centers where people want to gather,” CBRE says.

A study the firm published earlier this year found that vibrant mixed-use districts, comprising prime office buildings, multifamily units and retail, dining and entertainment amenities, had lower office and housing vacancy rates and higher asking rents than districts that were primarily business-oriented.

Since 2020, 42% of completed office conversions and 52% of those currently planned or in progress have been in business-centric districts, according to C fBRE’s November conversion report. The growing conversion activity is anticipated to reshape business-centric districts into dynamic mixed-use neighborhoods, the firm says.

Older office properties that are largely vacant and within or near existing active mixed-use districts also present strong conversion opportunities, CBRE notes. Since 2020, 5 million square feet of office space in such areas have been converted to other uses, with an additional 17 million square feet of conversions currently in planning or development stages. Successful conversions, particularly those to hotels and multifamily housing, have the potential to enhance the vitality of these districts, the report says.

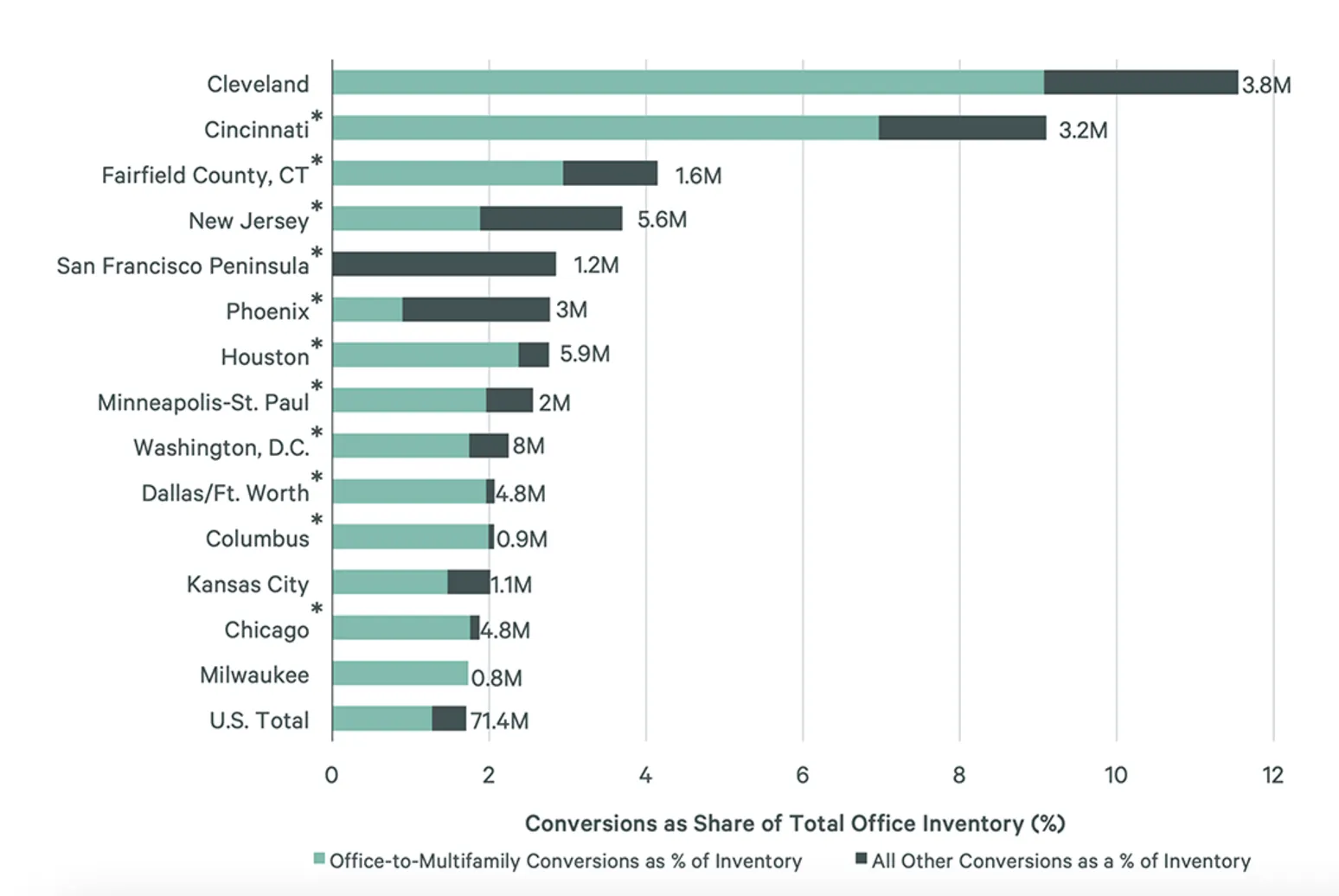

Office conversion activity varies by market due to local factors that influence project viability, the report states. These include property values, building size, construction costs and age of inventory. Cleveland currently leads the country in U.S. office conversions, with nearly 12% of its total office inventory either planned for conversion or undergoing one, the report says. The city’s relatively high construction costs and low office rents, alongside limited land availability, prompted local developers to pursue conversions “well before the pandemic,” according to the report.

In larger gateway markets like Washington, D.C.; Dallas-Fort Worth; and Chicago, less than 2% of total office inventory is currently undergoing or planning conversions, however, the report notes. It points to Chicago’s LaSalle Street Reimagined project as an example of how municipal support could spur conversions and build mixed-use communities.

Many U.S. cities are removing barriers to increase the financial viability of repurposing obsolete office space, CBRE notes. In addition to providing financial incentives, officials are working to ease zoning restrictions and expedite project approvals, its report says.