Dive Brief:

- A rise in office foot traffic has driven an uptick in desk and room bookings during the first half of this year, according to a recent report from Robin.

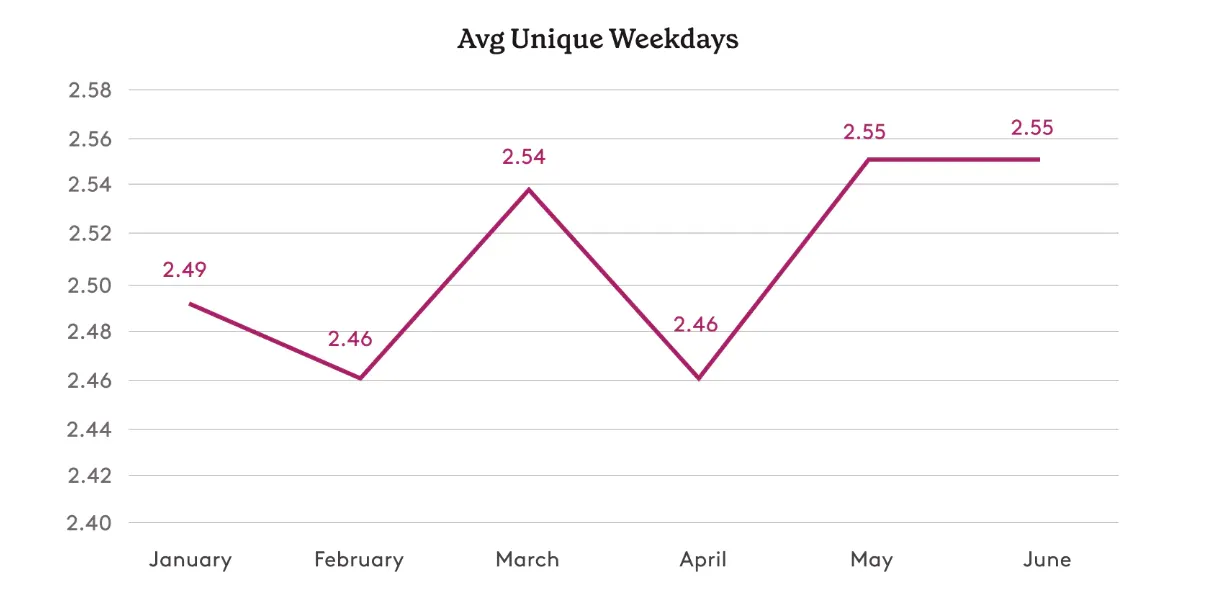

- Customer data gathered by the hybrid workplace experience platform points to a 20% climb in total desk bookings from January through June, with each employee scheduling 2.6 days on average during workweeks in May and June.

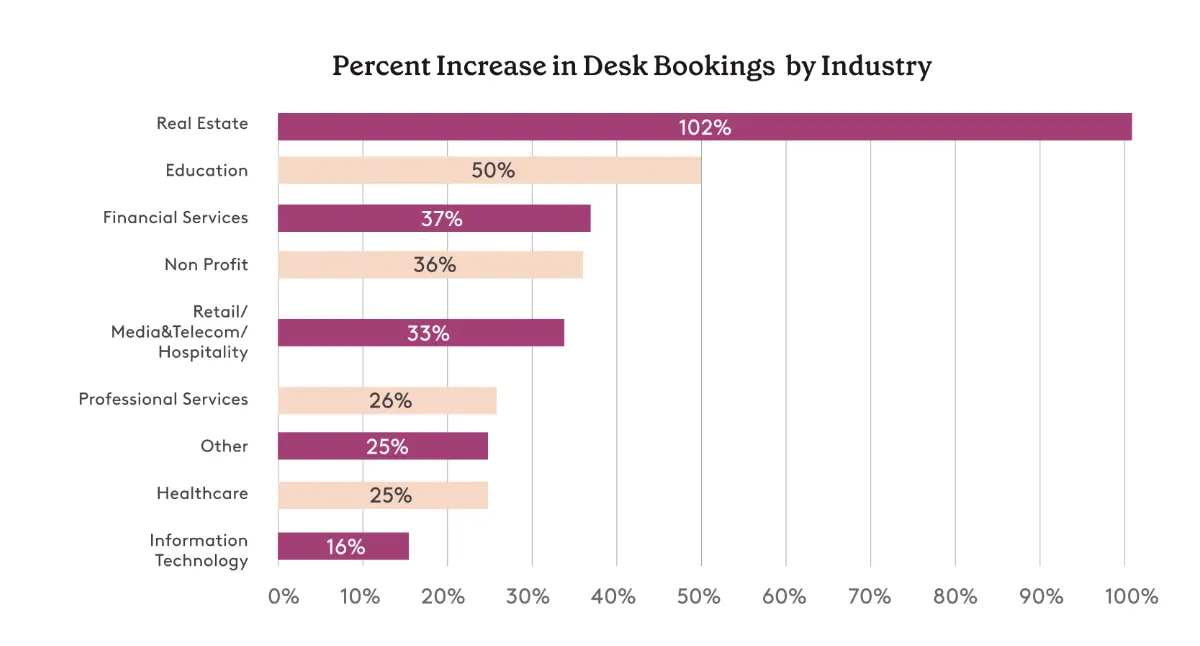

- The real estate sector leads this trend with a 102% jump in desk bookings since January, followed by educational institutions (50%) and the financial services industry (37%), the report found.

Dive Insight:

Non-profit organizations saw a 36% increase in desk bookings, and the retail, media, telecom and hospitality outposts took the fifth spot with a 33% rise.

The biggest increase in desk bookings occurred in March and May, which both saw a climb of 20% or more from the previous month, Robin’s data analyst Mark Pessinis said in the report.

The report added that Sacramento has seen the biggest surge in desk bookings (31%) since January. Washington and Los Angeles came in second and third, with desk bookings increasing 29% and 27%, respectively.

Robin’s study also points to a 25% increase in meeting room bookings across the U.S, underscoring a scenario where more employees are being drawn back to offices for an average of about 2.1 days a week.

“The days of facilities managers being the office fixers are over. The role now calls for facilities managers and leaders to create modern workplaces that today’s workers want to spend time in. Cubes are out. Open spaces that enable collaboration for when people are in the office, are in,” Micah Remley, CEO of Robin told Facilities Dive.

With hybrid culture becoming a fixture of the post-pandemic office model, employees want more structure to manage their workflow.

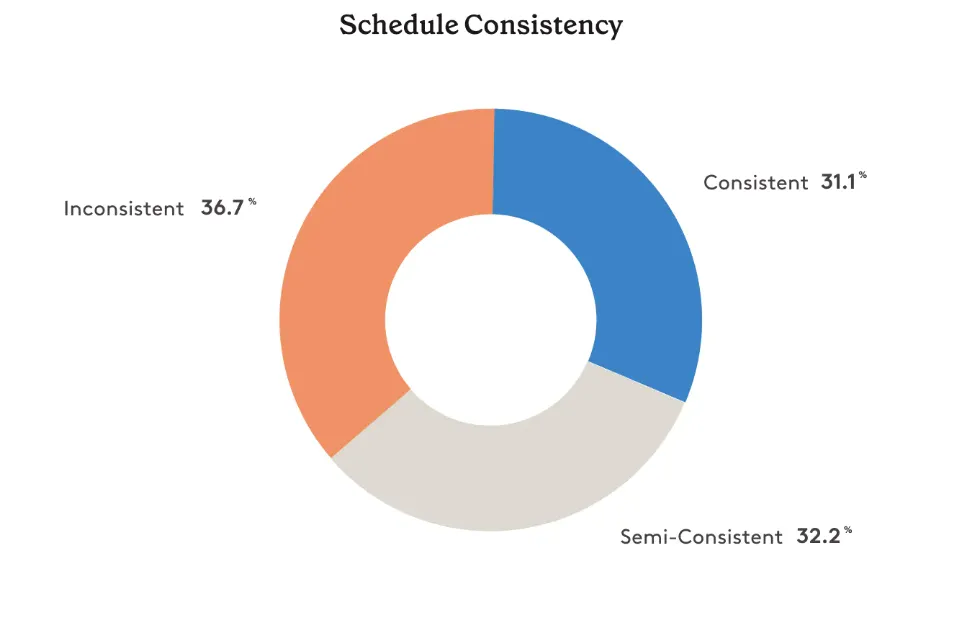

A survey conducted by Gallup, roping in more than 140,000 US employees, found that 6 in 10 employees prefer structured hybrid work. Robin’s report corroborates that trend with data that reflects a growing consistency in schedules for hybrid workers across the board.

But another recent survey conducted by Mercer found that only about 34% of organizations have clear, transparent and formal rules in place for hybrid employees. The study, which surveyed 749 organizations, noted that 48% turn to ambiguous guidelines to manage flexible work, while 17% are “completely hands off.”

Robin’s data shows that 91% of organizations that have enabled a formal hybrid work policy through its platform have a two-to-three day frequency with consistent or semi-consistent schedules that land employees in the office for about 2.5 days a week.

Although 66% of companies with more than 50,000 employees allow for structured hybrid work, only 13% are fully flexible in terms of giving employees control over whether and when to come into the office, according to a Q2 '23 Flex Report.

Remley expects weekly desk utilization numbers to “rightsize” as more workers come into smaller offices with fewer desks, while companies shift from hiring remote employees to local workers. “Utilization was under 20% in the early days of the pandemic, but now sits closer to 30%. I expect that number to grow,” he said.

With a larger share of offices moving toward hybrid work, companies end up paying for empty office space on certain days of the week. Sanjay Rishi, CEO of JLL’s Americas Work Dynamics business, believes facility leads can meet this challenge by reevaluating office layouts and optimizing space utilization through strategic allocation, utilization monitoring and innovative design concepts that foster collaboration, productivity and well-being.

“Facilities management professionals can play a crucial role in designing and optimizing hybrid workspaces. They can create flexible layouts that cater to the needs of remote, hybrid and in-person employees by integrating technology and adaptable furniture solutions. “For employees using the space, there needs to be a ‘We Space’ for collaboration and a ‘Me Space’ for more heads-down work. Additionally, they should invest in robust technology infrastructure to support hybrid work and create seamless user experiences with booking and reservation systems,” Rishi told Facilities Dive.

Office occupancy rates have rallied in the recent past, hovering around the 49% mark during the week following the Fourth of July, according to swipe data from Kastle’s Back to Work Barometer.

The middle of the week is the most popular time for workers to come into the office, with Kastle Systems data pointing to an occupancy rate of nearly 60% last Tuesday.

Kwame Watkins, president of Jengo Facilities LLC, which works with charter schools, warehouses, logistics companies and IT firms to support their facilities management operations, believes regional occupancy variances across locations are driven by transport availability and overall foot traffic.

“Downtown core is a tougher sell than a suburban location, where you get less traffic than the core,” he said in an interview. “If we stay at the 50% mark, I think we'll be in good stead. What I've seen is a lot of mandates to come back to the office. But, in a lot of cases, people don't adhere to them fully.”