Dive Brief:

- National office demand in the third quarter was half of pre-pandemic levels, according to VTS’ quarterly office demand index, or VODI.

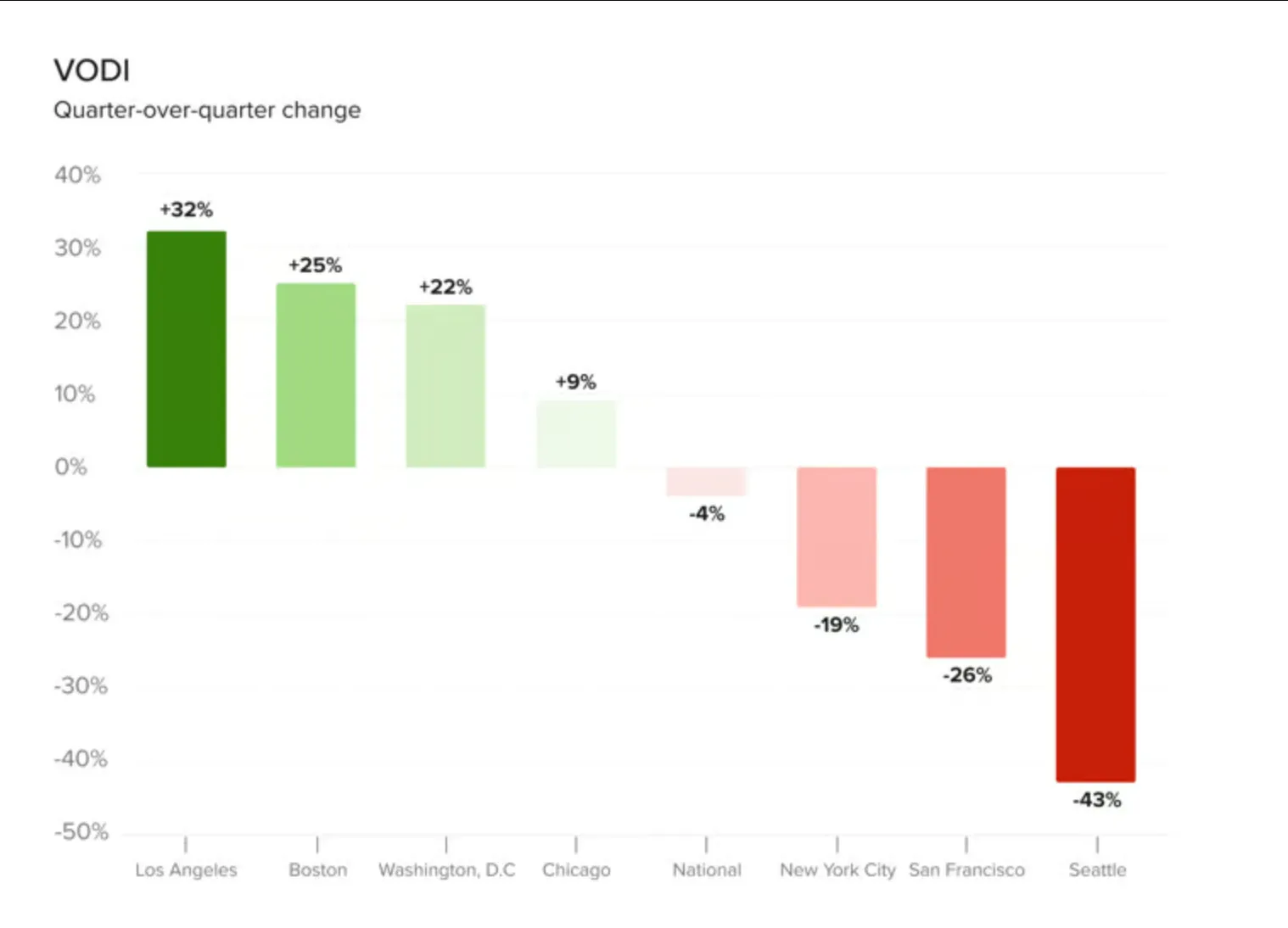

- Los Angeles experienced its second-strongest demand quarter since the pandemic started; Seattle’s office market crashed in the third quarter; and Chicago and Washington, D.C., continued on steady declines, VTS said.

- For 24 consecutive months, new demand for office space has remained at a relatively stable level — between half and two-thirds of the demand of its average pre-pandemic level. VTS expects this trend to continue “for the foreseeable future.”

Dive Insight:

VTS calculates the VODI based on pre-pandemic demand levels such that the average level of new demand in 2018 and 2019 equals 100. The national VODI in September was 51, a two-point decline from the last quarter and three points higher than a year ago. Despite that yearly increase, VTS says that national demand has been steadily declining at a rate of 0.4 VODI points per month, or about five points per year, from October 2021 to September 2023.

The company attributes this decline to a cooling job market, elevated interest rates and the prevalence of work-from-home, which remains persistent. Job postings, a leading measure of the state of the labor market, have also declined “considerably since peaking in 2021” and have yet to rebound, the report said.

On the other hand, work-from-home rates are now on the rise, the company said. The report cited WFH Research, which found that the percentage of workdays worked remotely across all industries in the 10 largest U.S. metro areas has been rising since bottoming out at 32.7% in November 2022. As of August 2023, it was 34.3%. “The ‘return-to-office’ seems to have ended or at least paused. This flat-lining of work-from-home levels seems to be a feature of the new normal,” the report said.

Despite a cooling job market, which would typically grant employers greater leverage in persuading employees to return to the office, work-from-home rates are likely here to stay, VTS said, thus employers are likely to need less office space, if any.

Regionally, Los Angeles’s office demand grew 32.1%, to 74% of its pre-pandemic level, in the third quarter, up 19.4% year over year. Apart from a brief increase in May 2022, this represents the city’s highest level of demand since a post-vaccine wave in summer 2021, when its demand index rose above 100. Demand in Boston and Washington, D.C., also increased 25% and 22%, respectively, with Chicago seeing a mild 9% rise last quarter.

Seattle saw the biggest drop in office demand, falling 43.2% ,to 21, in October from its VODI of 37 in June. That means demand sits at roughly one-fifth of its 2018 and 2019 levels, and 52.3% lower than this time last year. While Seattle did see “considerable new demand” in the medium-sized 10,000- to 50,000-square-foot category, it had “no new requirements at all for large spaces in the 50,000+ square foot category since June,” VTS said.

The report also noted that Los Angeles, New York City, San Francisco and Boston have remained relatively flat in demand since October 2021, with estimates of average monthly change that are “not statistically different from zero.”

Despite similar trajectories, these cities differ in how “friendly” they are toward remote work, VTS noted. The report said the VODI gap between more-remote-friendly and less-remote-friendly cities was the widest it has ever been; it said a possible explanation is that remote-friendly cities, or those where more of the workforce can potentially work from home, have been more “amenable to remote work, and therefore seen a greater reduction in new office demand versus pre-pandemic levels.”