Dive Brief:

- Healthcare and hospital amenities are increasingly important factors for younger generations when deciding to return to first-time providers for subsequent visits, according to a JLL healthcare sentiment report sent to Facilities Dive.

- The 2023 Patient Consumer survey shows that 80% of Gen-Z individuals aged 18-26 and 77% of millennials aged 27-42, from a pool of 4,037 respondents, desire additional amenities in healthcare settings, compared to 62% of Gen Xers in the 43-58 age group and 44% of baby boomers aged 59-77.

- JLL points to a need for additional investments in facilities management and improvements as a measure of positive experience with patient care.

Dive Insight:

Healthcare facilities are strongly considering offering additional amenities in a bid to make patients more likely to choose those providers for longer-term care, according to the survey, which polled 4,037 U.S. residents in late April 2023.

“Colocation of traditional medical office space with primary care or specialists could allow health systems to utilize their current real estate portfolio more fully and, if done well, provide consumers a first, positive experience with that health system, making them more likely to choose the provider when it comes time for care,” JLL healthcare’s research team, comprising Kari Beets, Jay Johnson and Alison Flynn Gaffney, wrote in the report.

That statement is reflective of a trend where younger people who visit medical providers in physical healthcare locations are increasingly seeking additional amenities, ranging from medical spas and fitness facilities to restaurants, cafes and alternative medicine. They are also less likely to have primary care providers, and a visit to urgent care or emergency care is often their first experience with the hospital system.

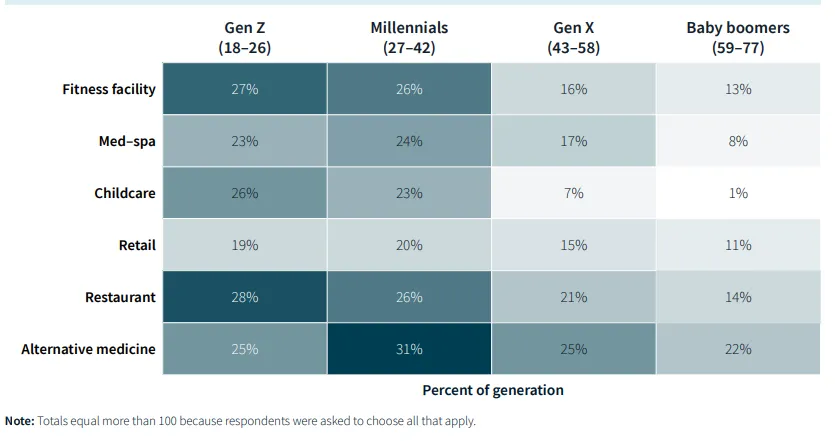

Twenty-seven percent of Gen Z respondents and 26% of millennials stated that they would like to see fitness facilities in healthcare settings, compared to 16% of Gen X and 13% of baby boomers. Medical spas elicit the interest of 47% of individuals aged 18-42, compared to just 25% of individuals aged 43 and above.

“Whether it be retail components like pharmacies, gift shops or other wellness services such as medical spa and fitness services, the organizations that are making these investments are creating more opportunities of convenience for their patients and team members. That results in enhanced loyalty and can make the difference in clinical provider selection as well as where one wants to work,” JLL’s healthcare division president Alison Flynn Gaffney said in an interview.

“Consumer demographics and psychographics such as spending habits on health and wellness as well as the proximity of care provider competition are key to identifying market gaps and opportunities,” Jay Johnson, JLL’s U.S. practice leader of healthcare markets, said in an interview.

Johnson points to the need for care providers to engage in evidence-based decision-making centered on data and analytics that draw upon geographic information systems. “Physician groups and health systems can achieve this to some degree internally, but should consider partnering with outside platforms for a more well-rounded view, supported by well-informed data and analytics,” he added.

The quality of facilities is listed among the top-five factors that drive a person’s decision to return for subsequent visits after a first-time experience with emergency care, urgent care and in-patient care. However, the quality of facilities such as maintenance, cleanliness, adequate seating and the effectiveness of heating and cooling systems ranked the lowest in terms of their ability to ensure a positive patient experience.

Comfortable waiting spaces had the second-widest differential between individuals who would recommend a first-time provider and those who would not. The level of comfort in exam spaces was a close third, followed by a healthcare facility’s approach to maintenance and the level of hygiene, in terms of a gap between those who would recommend a provider and those who would not.

“Delays in accessing care over the past few years due to the pandemic and reduced workforce have resulted in more acute patient needs across the plethora of medical services a system provides, which in turn has caused … overcrowding and longer wait times within emergency and urgent care settings,” Gaffney said.

While financial constraints pose a challenge for facilities managers who are working to optimize space through restructures and new builds, they are “constantly reevaluating space needs in collaboration with clinical teams and working with their partners in safety and security, and environmental services to meet and exceed the demands of increased needs for medical care within our communities,” she added.

Healthcare settings in urban areas got lower ratings for the quality of their facilities, indicating a host of challenges with poorly maintained infrastructure, difficulty landing a parking spot and wayfinding.

Johnson emphasizes that locational convenience and accessibility are crucial to delivering care and building patient loyalty through positive experience. “Seventy percent of consumers say that location convenience is…extremely important to how they choose a provider — second in importance only to acceptance of their insurance,” he said.

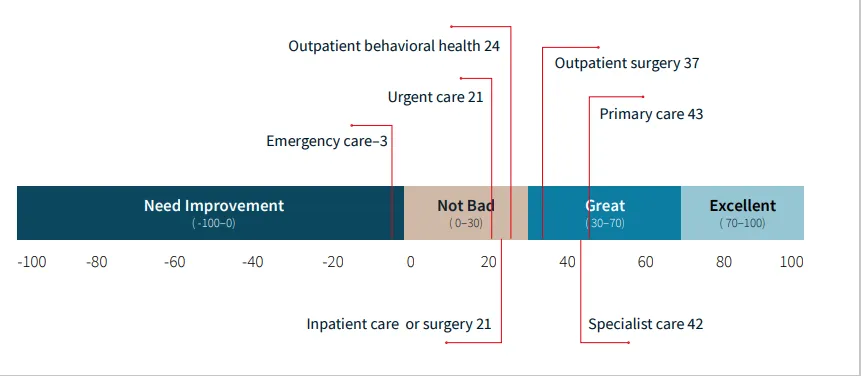

JLL recommends that facilities managers use a “net promoter score,” while gathering feedback from patients to acquire insights into their experience of the physical location of the provider they visited. “By visualizing care feedback by location on a map, connected with property information, a health network or physician group can identify outliers and examine if patient experience with the facility or provider is likely to be driving the overall score,” the report said.